Another alcohol price hike could drum up an extra €140m for the public purse

An Irish Tax Institute report also considered the State’s options for ditching tourism’s 9% VAT rate.

HIKING THE PRICE of cider, beer and spirits by 10c could generate more than €100 million for the public purse.

That’s according to a pre-budget report compiled by the Irish Tax Institute, the body that represents chartered tax advisers.

The report considered various policy changes that could be introduced in Budget 2019, which will be unveiled next month.

It found that further taxing of “old reliables” like alcohol and cigarettes could generate hundreds of millions of euro for the Exchequer.

Ireland already has one of the highest rates of excise duty on alcohol products in the EU.

A 10c duty increase on a pint of beer or cider and half a glass of spirits could yield a total €116 million, while a 50c hike on the price of a bottle of wine could generate an extra €30 million alone.

Meanwhile, slapping a duty increase of 50c on a 20 pack of cigarettes could bring in an extra €57.8 million, according to the Irish Tax Institute.

9% VAT rate

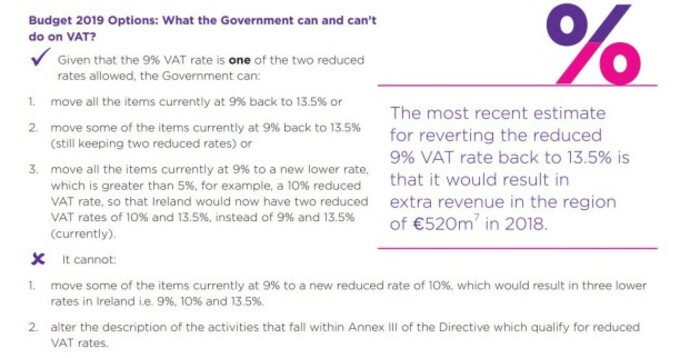

The organisation also considered the options available to the government when it comes to reversing or altering the 9% VAT rate for the tourism industry, which was initially introduced as a temporary measure in 2011.

The preferential VAT rate – which also benefits restaurants and certain entertainment providers – has come under fire at a time when hotels across the country enjoy record profits.

A Department of Finance analysis on the discounted levy found that restoring the 13.5% rate for tourist accommodation alone would bring in an extra €208 million in tax annually.

Click here to view a larger version

The Irish Tax Institute estimated that if the 9% VAT rate was reverted for all sectors that avail of it – which includes non-hospitality sectors like hairdressing and newspapers – the Exchequer would rake in an extra €520 million.

The report said that the government could move some or all of the items currently taxed at 9% back to the 13.5% rate, but it cannot introduce a third reduced rate under EU rules.

Tourism Minister Shane Ross previously suggested that large hotels should pay a higher VAT rate than smaller ones but didn’t explain how such a system would work.

The Irish Tax Institute’s report also considered two options for reducing the 33% capital gains tax, which has long provoked the ire of business lobby groups.

The first option explored reducing the rate to 30% over one or two years, which would cost the State an estimated €102 million to implement.

Meanwhile, dropping the rate from 33% to 25% over a two- to four-year period would cost €272 million.

A paper prepared by the Department of Finance’s tax strategy group previously said that a change in the overall rate of capital gains tax could improve the country’s business environment.

“(It) would enhance economic growth, increase transactions, increase Exchequer revenues and assist in new company formations,” the paper said.