Entrepreneurs fear loan rejection as banking crisis 'scars' run deep

Almost half of small Irish companies won’t apply for credit for fear they will be knocked back.

IRISH ENTREPRENEURS ARE so apprehensive about having their loan application knocked back that they don’t bother applying in the first place.

A new joint study by Irish and Spanish researchers found that the fear of applying for a business loan is a greater problem for Irish SMEs than a possible lack of available credit.

More than 6,000 small- and medium-sized firms in nine eurozone countries were interviewed for the survey, which found the Irish contingent were the most likely to avoid a loan application altogether for fear of rejection.

One of the study’s lead authors, TCD professor Brian Lucey, said it is the responsibility of the banks and governments to educate SMEs about the credit that is available to them.

“The banks need to make clear to people that supply constraints are not as bad as they think,” he said.

“There is only so much credit you can get from venture capital and money pooled together from family and friends. Investment loans are a realistic source of credit.”

He added that state bodies also need to convince banks to investigate SMEs that have not shown an interest in applying for a loan.

“This is not to advocate pushing credit on unwilling customers – it is to suggest that we should focus more on those who could borrow for good projects but who do not.”

Germany had the next-highest ‘fear of rejection’ rate after Ireland, although the share of businesses there citing the same reason for not applying for a loan was just above half that in the Republic.

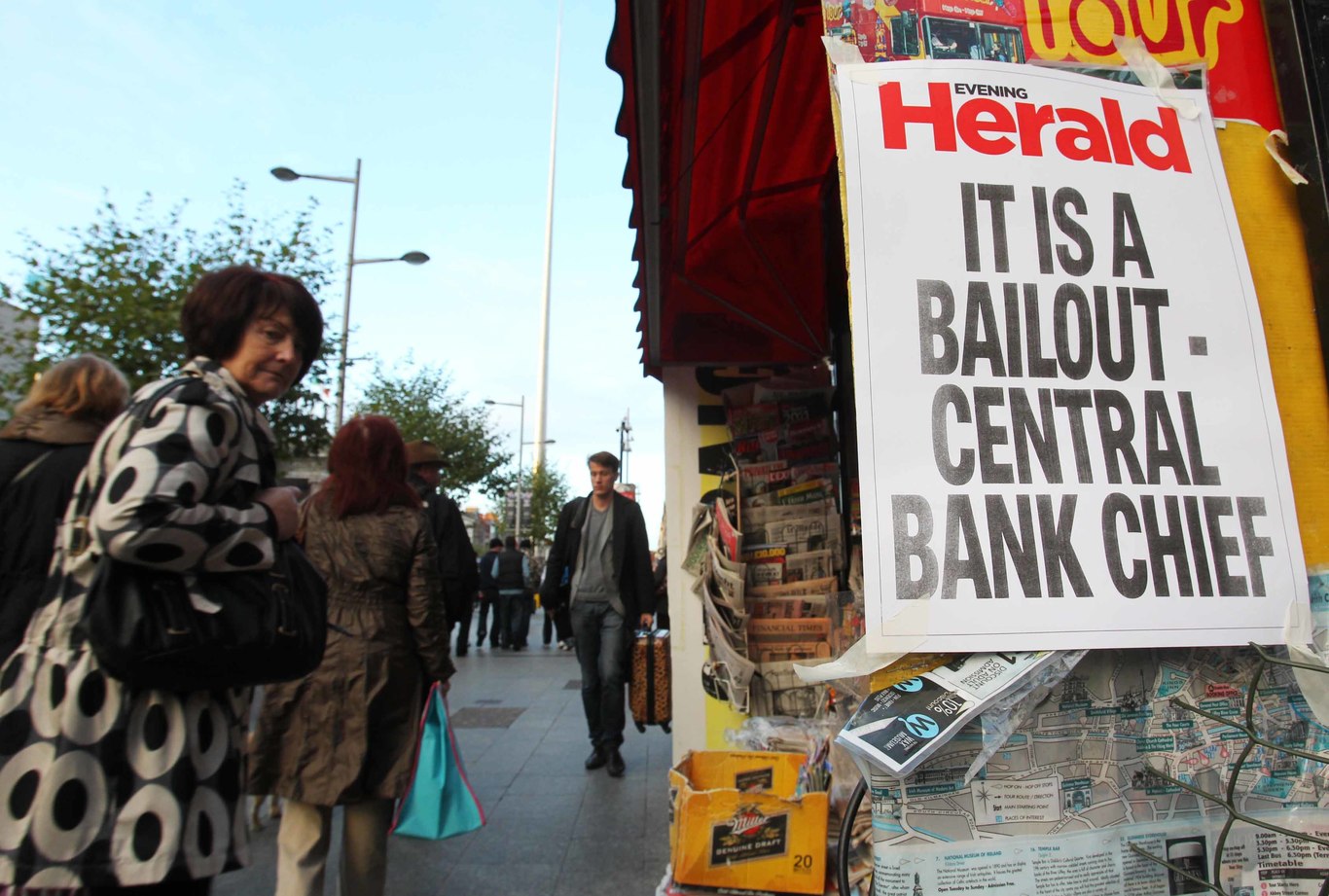

Lucey said he thinks the reason why Ireland compares so unfavourably to other eurozone is because the banking crisis still looms over the heads of business owners.

“People are still coming out of a mega crisis and those scars are long lasting. In a sense you would hope that they would be because you don’t want people borrowing foolishly. You want the system to learn.”

The most recent bank watch survey from business group ISME found the refusal rate for SME loans stood at 43% in the first quarter of the year. That was slightly down on the figure from late 2015, while demand for finance had risen over the same period.