Startup investors are ready to splurge their cash around Europe once again

Funding dropped around the Brexit vote, but Dublin could soak up fintech funding once marked for the UK.

THE EUROPEAN FUNDING market is back open for business and could see a spike in funding activity as the dust settles on the Brexit referendum result.

That’s according to the latest CB Insights/KPMG venture pulse report, which has tipped the European venture capital market to bounce back throughout the rest of the year and see substantial levels of funding activity.

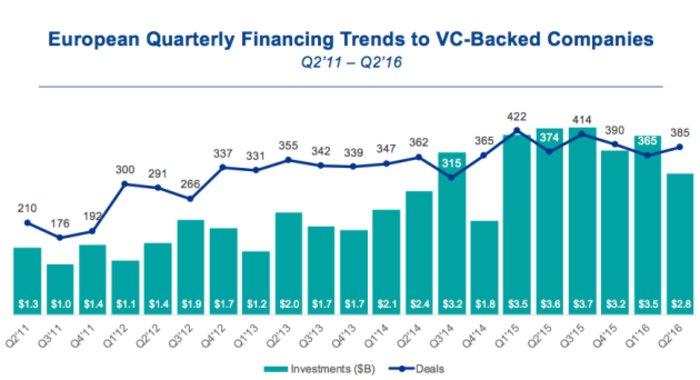

Venture capital activity in Europe began at a steady pace this year, however it took a dip in the second quarter as investors appeared to get cold feet around the Brexit vote.

Over the past three months, the total amount of money invested on the continent dipped to the lowest levels since the last quarter of 2014, with a 40% drop in VC investment in the UK alone.

Even though European levels of funding are expected to bounce back, CB Insights research director Marcelo Ballve said there is still a lot of uncertainty hanging over the UK – which has investors concerned.

“There’s worry about everything – from key EU and foreign limited partnerships shifting away from UK funds, to venture capitalists themselves cooling on UK and even European-based startups given uncertainty surrounding regulations and market access,” he said.

“The bottom line is that uncertainty is rarely good for a market, and the actual impacts of Brexit will not be known for a while.”

Click here for a larger version

Not all bad news

Despite the reports that Britain is going to suffer from a significant startup drain as companies flood out of the country to find new bases for their operations, some VC firms have rallied around the troubled nation.

Investment organisations Index Ventures, Entrepreneur First and Seedcamp, to name a few, have all publicly declared themselves open for business and still interested in financially backing UK companies going forward.

Recent investment activity has shown there may be merit to their pledge after a number of large late-stage deals took place in the country at the tail end of the quarter.

The UK-based peer-to-peer money transfer service TransferWise raised $26 million and life sciences company F2G received $60 million in funding. This could be put down to the weakening of the pound, which has made Britain a more attractive investment option.

Even though some investment firms have moved to calm fears that UK companies will struggle to raise funding, the joint CB Insights and KPMG report highlighted that certain cities are in line to benefit before the ramifications of the Brexit vote become clear.

In the short term, cities like Dublin – alongside other European startup hubs such as Berlin, Barcelona and Paris - have been tipped to pilfer a share of the fintech funding that has been traditionally poured into predominantly London-based companies.

Analysis for the first quarter of this year by CB Insights showed that the UK’s fintech industry alone amassed around €170 million in funding.

IPOs lagging

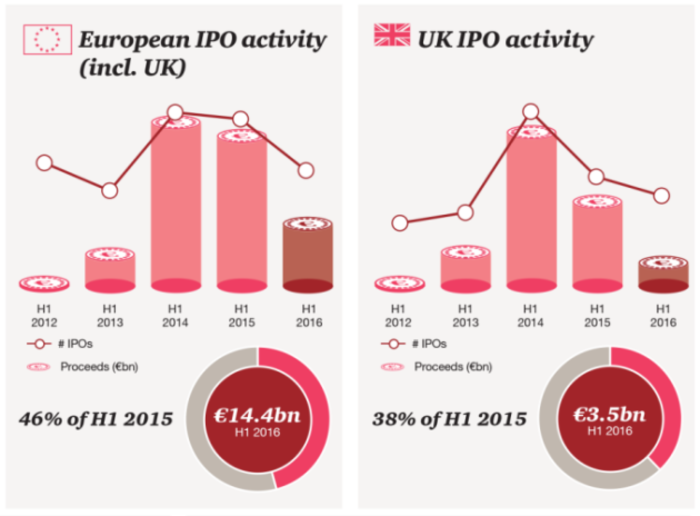

While the levels of VC funding in Europe could bounce back over the rest of the year, another report from consultancy firm PwC has predicted that IPO activity in Europe is going to fall significantly short of the levels seen last year.

In 2015, over €57 billion was raised through public offerings in Europe and this year IPO proceeds are unlikely to exceed €25 billion.

This massive dip in IPO funding has been partially caused by a 75% dip in activity in the UK market in the second quarter of this year. The rest of Europe, in comparison, only saw a 6% fall in activity.