The weak pound post-Brexit has spurred Europe's biggest-ever tech takeover

Cambridge chip designer ARM is being snapped up by Japanese firm SoftBank in a £24 billion deal.

JAPANESE MOBILE GIANT SoftBank has agreed a cash takeover of iPhone chip designer ARM Holdings for around £24.3 billion, the pair said today, in a major investment boost for post-Brexit Britain.

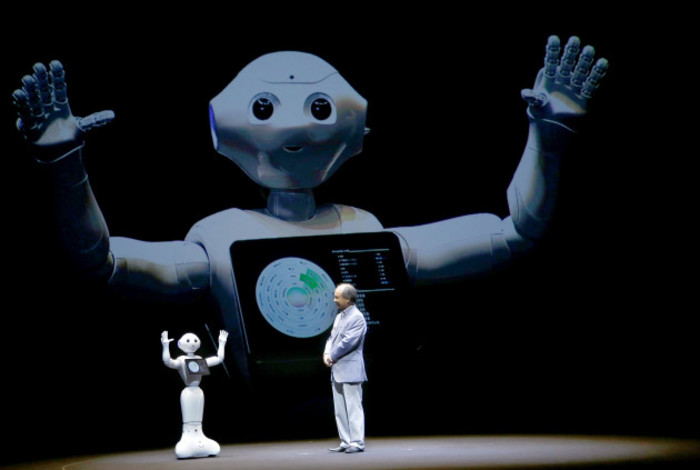

“We have long admired ARM as a world renowned and highly respected technology company that is by some distance the market-leader in its field,” SoftBank chairman and chief executive Masayoshi Son said of the deal, which valued the British group at about €29 billion.

Son added that the deal marked SoftBank’s “strong commitment to the UK and the competitive advantage provided by the deep pool of science and technology talent” in the university city of Cambridge where ARM is headquartered.

Britain’s new finance minister Philip Hammond praised the mega deal that comes amid warnings about a slowdown to growth in the country after its vote last month to exit the European Union.

“This £24 billion investment would be the largest ever from Asia into the UK,” Hammond said in a separate statement.

“It would guarantee to double the number of jobs in ARM in the UK over the next five years and turn this great British company into a global phenomenon.”

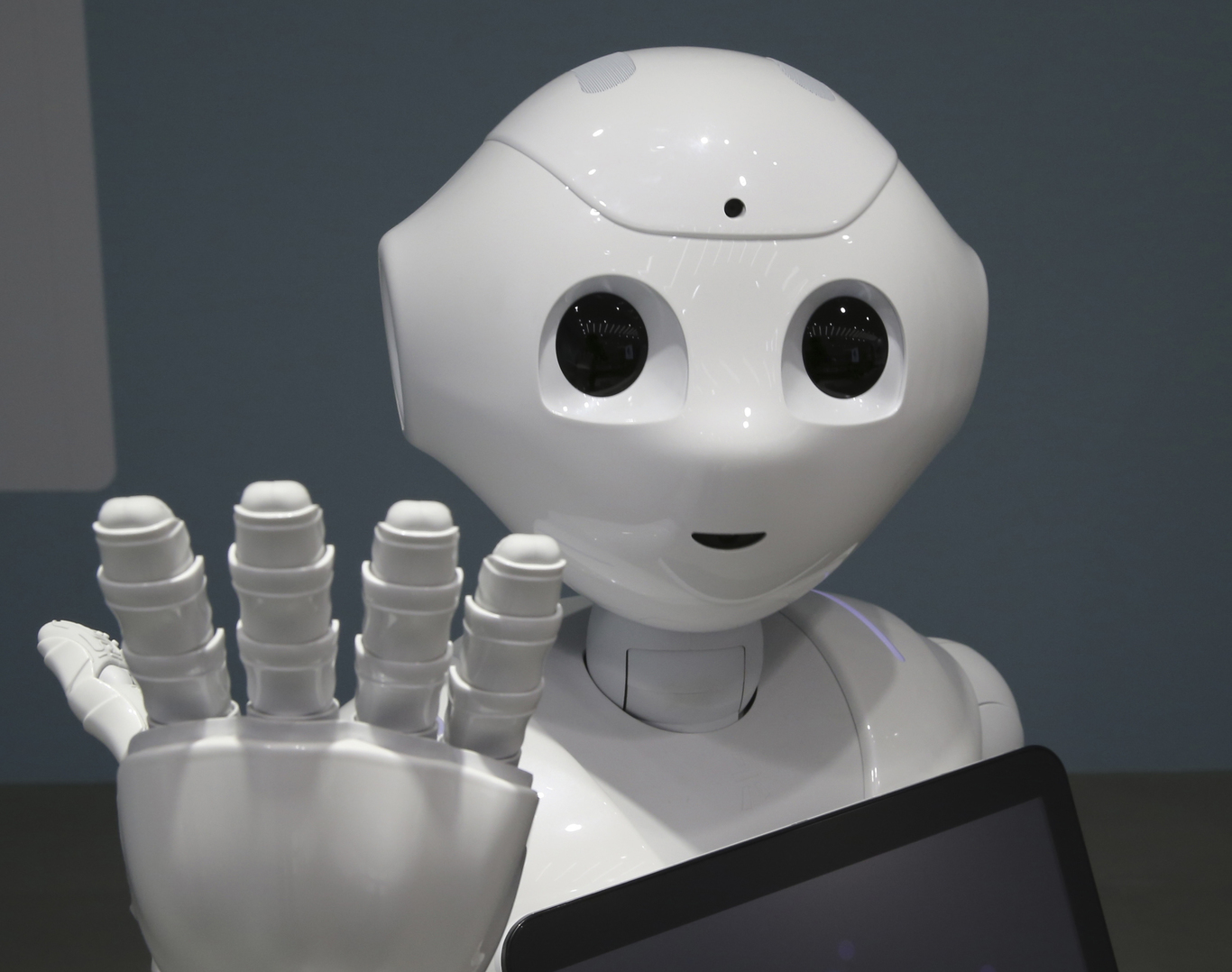

The deal is also thought to be the largest-ever buyout of a European tech firm. Alongside a string of mobile and internet-related products, SoftBank is also the company behind the Pepper humanoid robot.

Weak pound

Analysts said the vast weakening of the pound, in particular against the dollar, since the referendum result is making British companies attractive for foreign groups.

“We can see in this deal the effect of Brexit and the collapse in the pound as British companies become ripe takeover targets,” said Neil Wilson, analyst at ETX Capital trading group.

“A lot more British firms could become foreign-owned quite soon,” he added – also after South African general retail group Steinhoff International last week agreed a takeover of British discounter Poundland for around £597 million.

SoftBank meanwhile said it would offer £17 for each ARM share, a premium of around 43 percent compared with Friday’s closing price of £11.89. That resulted in ARM’s share price rocketing 45% in early trade today.

The deal values the company’s total share capital at around £24.3 billion.

ARM develops and licenses technology central to digital electronic devices, including those made for Apple’s fierce rival Samsung.

The British company’s customers shipped “about 15 billion ARM-based chips” in 2015, up almost a quarter year-on-year, according to the group’s website. Almost half of the chips were used for mobile phones and tablets, it added.

ARM’s revenues meanwhile jumped 15% to almost $1.5 billion last year on the design of chips used also in computer servers.

Additional reporting Peter Bodkin