'Ireland can be a world leader in fintech, but we're still very far off reaching our full potential'

Regulators should make it easier for small firms to test new products and innovate.

IT WAS CHARLES Darwin who once said that those who can adapt are ultimately those who succeed in life.

The same is true in financial services. Putting it simply – adaption is king. And adaption in how we organise our financial system; how we interface with customers and meet their needs will define those businesses who succeed and fail into the future.

We are living in the midst of the disruption age, when businesses come and go at lightning speed. From politics to business to investment, the pace of change is breathtaking. Businesses that were once seen as impregnable world leaders can be taken down in weeks.

Technology today makes such a difference in winning new markets and growing your business. It is the defining mark of business success or failure in today’s globalised world. This trend will multiply over the next decade, as it has in the last.

In Ireland, we need to embrace new financial technology. We’ve done reasonably well so far, but we’re still very far off reaching the full potential that this new digital finance world can offer.

Look at the UK, look at Netherlands – they’ve created an innovative space where new financial technology solutions can flourish.

A regulatory sandbox

The main reason for this is through the creation of ‘regulatory sandboxes’. A regulatory sandbox is a controlled environment set up by a regulator or central bank that allows businesses to test innovative products, services or business models in a live setting.

It is time that the Central Bank, in collaboration with the Department of Finance, developed a regulatory sandbox for Irish financial firms to test new and innovative products before they go to market.

The great thing about a sandbox is that small businesses, that are unauthorised, can test their ideas before they go through the long authorisation process.

The creation of a sandbox in Ireland would give us the confidence to take a giant leap into the fintech world. We have a fantastic startup culture, particularly in Dublin, that would welcome this with open arms.

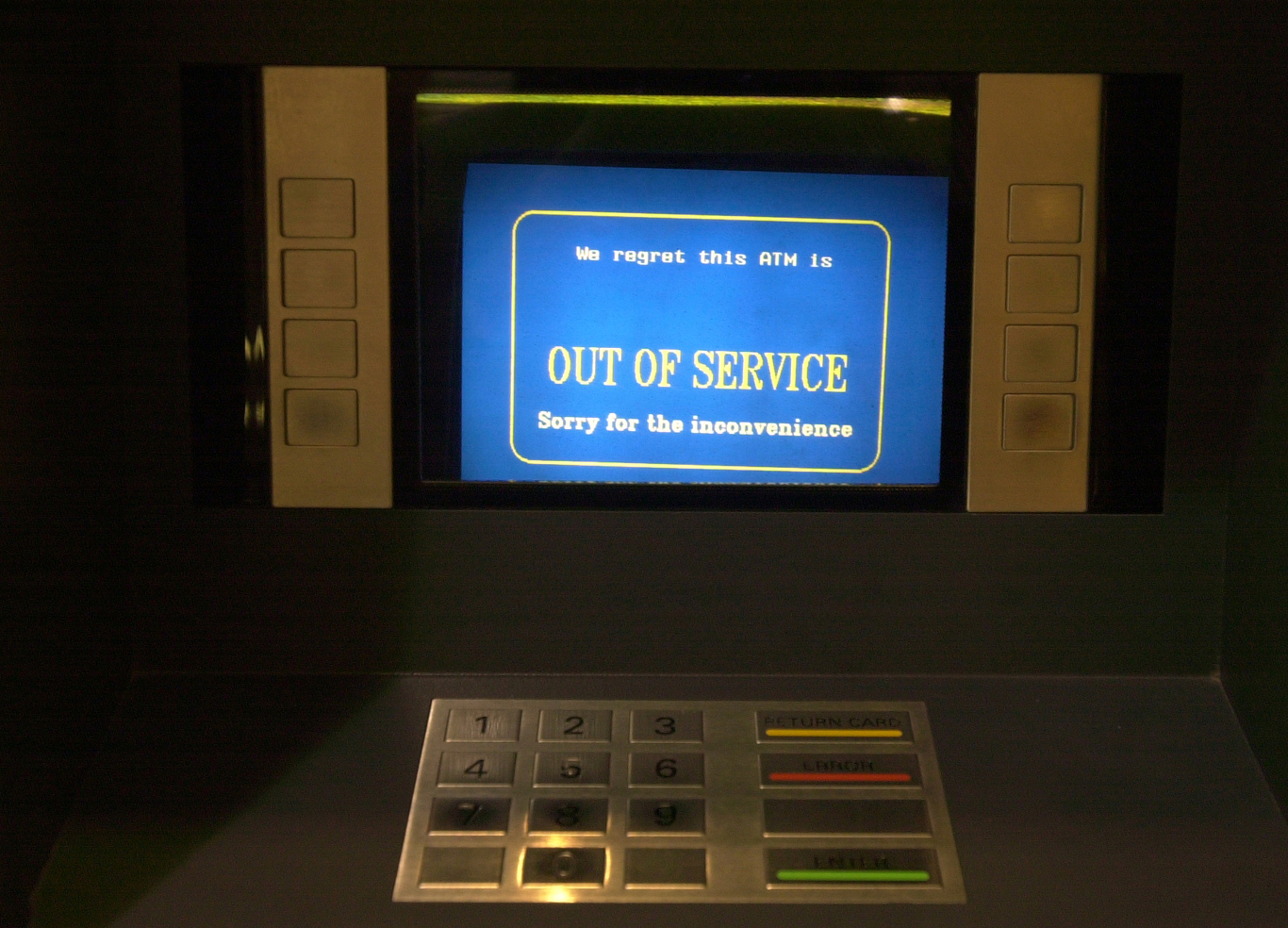

A technology solution can make an idea become an instant success. Old models of distribution, in banking for instance or insurance, can profoundly change as branches and distribution networks become obsolete as more and more business migrates to online platforms.

The cases of Ulster Bank and An Post, just this week, highlight how quickly things are changing and how those in the area of financial services, public or private, have a responsibility to explain why these decisions are necessary.

But in all of this it is important that people are not left behind. Assumptions about personal levels of tech competence or knowledge cannot be taken for granted. And, of course, assumptions about the level of national or regional connectivity, also need to be understood.

Pretending that people should use online services without proper broadband is another dangerous assumption.

Equally, the financial sector cannot underestimate the degree to which trust was sundered as a consequence of the financial crisis in Europe and especially in Ireland.

Europe has helped Ireland in restoring financial stability both in our public finances and in our banks. That stability cannot be put at risk.

As financial services move at warp speed into the digital age, with new technology and an enhanced product and service offering, underlying all of this must be financial stability. Trust in banking and trust in financial services must be earned.

At the heart of this disruption is the interface between finance and technology. In essence that’s what fintech is: an enabler to improve the transfer of money across the financial system in a reliable and cost-effective way that brings added value to customers and the businesses that use the technology.

Small-country advantage

Over 140,000 people plus work in the finance and technology space in Ireland. We have lots of success in IT and lots of success in financial services. We have businesses from multinationals to micro-startups all operating in this space. Ireland as a small country has an advantage to move quicker than others because of our size.

And that’s why we can become world leaders in the fintech space. The talent pool of people is exceptional in Ireland. Getting out ahead of others and using our national advantages in IT, finance, regulation, diaspora, exporting and strong business startup and entrepreneurial culture, are such an asset that policy makers need to harness.

The truth is that EU is catching up with many parts of the world where the fintech revolution has been at the heart of economic development for a much longer period. In Singapore, Hong Kong, Israel and on the west coast of the United States, we have seen tremendous growth in recent years.

And while Europe is catching up, across the EU the opportunity for a single digital market underlying the developments in fintech need to be realised by the EU and by member states. It has to be part of Europe’s economic comeback story since the financial crisis.

Brian Hayes is a Fine Gael MEP for Dublin. He is a member of the European Parliament’s committee on economic and monetary affairs.

If you want to share your opinion, advice or story, email opinion@fora.ie.