Mobile payments are taking off as Irish consumers embrace the technology

The share of people using mobile devices for payments has tripled across Europe in a year.

IRISH CONSUMERS ARE among the top users of mobile-payments technology in the world as the share of people using the systems dramatically increased in just a year.

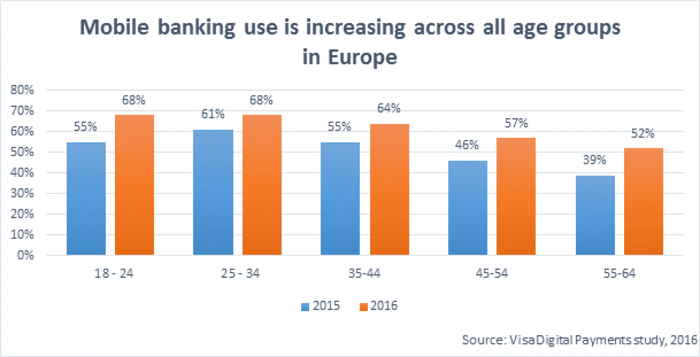

A study from Visa found the share of European customers regularly using mobile devices like smartphones or wearables to make payments has tripled since 2015 to 54%.

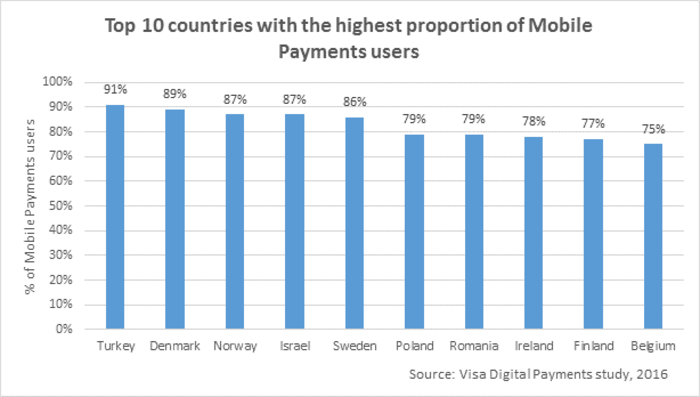

The survey of 36,000 online customers in 19 countries across the region showed that nearly four-fifths of Irish respondents used mobile payments – defined as anyone using a mobile device to manage their money or make transactions.

With that share, consumers here still lagged behind those in Turkey and several Nordic countries, where close to nine in 10 people used mobile payments.

The proportion of people in Ireland using mobile devices for banking has also increased significantly in the past 12 months – with more than half of the 55- to 64-year-olds surveyed adopting the technology.

More devices

Visa Ireland country manager Philip Konopik said the company saw smartphones and wearables being the start of a broader trend of connected devices making easy, secure payments possible from almost anywhere.

“In Europe, we’ve recently seen Apple Pay launched in the UK, France and Switzerland, Samsung Pay has launched in Spain and Android Pay in the UK,” he said.

“We’ve also seen a new era of wearable payments: smartwatches, wristbands and even clothing. It’s clear that this trend will continue to accelerate, enabling consumers to choose the connected device that fits with their lifestyle.”

In parallel with the explosion in people using mobile devices for payments, there has been a boom in young companies fighting for a piece of the digital payments market.

Limerick brothers Patrick and John Collison’s Stripe, which builds tools for third-party sites to handle online and mobile payments, has taken on investment from three major credit card companies, including Visa and American Express, on its way to a $5 billion valuation.