Irish startups are punching above their weight in attracting VC funding

Enterprise Ireland was the third-most active European VC firm during the last quarter.

IRISH COMPANIES RAISED the fourth-highest total venture capital funding in Europe during the final three months of last year.

In the last quarter of 2016, €220.8 million in venture capital funding was raised across 25 deals by Irish companies, 7% of the total raised in Europe, according to the latest Dow Jones VentureSource report.

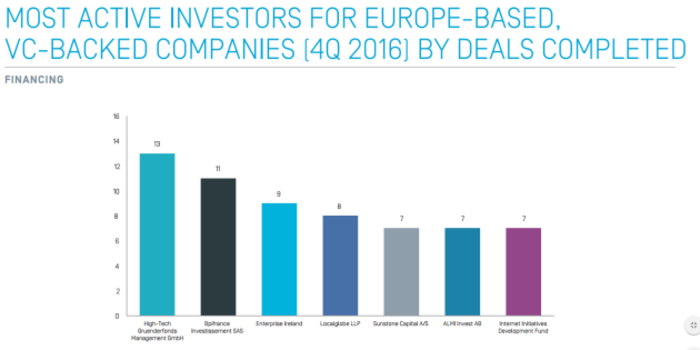

The research also found that Enterprise Ireland was the third-most active European-based investor during the period.

The state-funded organisation, which primarily uses taxpayers’ money to invest in Irish export businesses, completed nine deals in the final quarter of the year.

Based on the deal count, it was behind only German public-private fund High-Tech Gruenderfonds Management and French private equity firm Bpifrance Investissement.

Figures from the Irish Venture Capital Association for the year to the end of September tracked a record €734 million in funding deals for the first nine months of 2016.

However, as highlighted on Fora, the figures have previously been skewed by a few mega-deals in the life sciences sector for firms which, in some cases, have tenuous links with Ireland.

Global view

The VentureSource figures show that total European startup investment increased slightly in the final months of the year, with €2.93 billion raised from 539 deals.

That was a slight increase on the €2.73 billion raised in the third quarter – the lowest quarterly total in nearly two years.

The UK remained the most popular destination in Europe for VC investors. Companies based there accounted for nearly one-quarter of all funding in the continent, with €754.7 million invested across 122 deals.

France saw the second-highest level of venture capital investment, with €603.1 million committed across 62 deals. Germany was third with €525 million in investment.

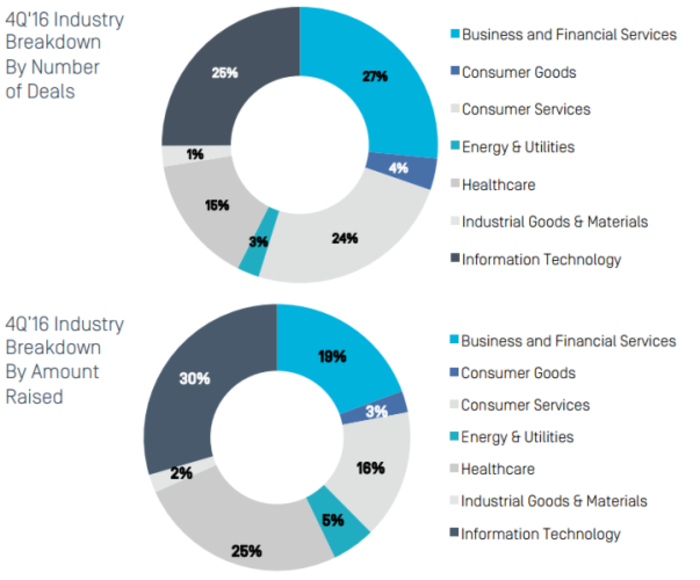

The IT sector drew the largest amount of investment, with startups in the category banking €866.4 million in 135 deals. This represented nearly a third of all money invested.

Other insights:

- European venture capital funds saw a slight increase in fundraising, with €1.6 billion raised. However, the number of fundraising deals decreased by 21%

- Total mergers and acquisitions was one deal shy of the number done in Q3, with the €1.7 billion acquisition of Skyscanner the blockbuster deal of the quarter

- The number initial public offerings by European companies increased slightly, but the amount raised decreased.