The Irish economy is haemorrhaging over €2 billion each year due to illicit trade

High cigarette and alcohol taxes are driving activity in the black market, a new report says.

ILLICIT TRADE IS costing the Irish economy up to €2.3 billion each year as government policies drive up demand in the black market.

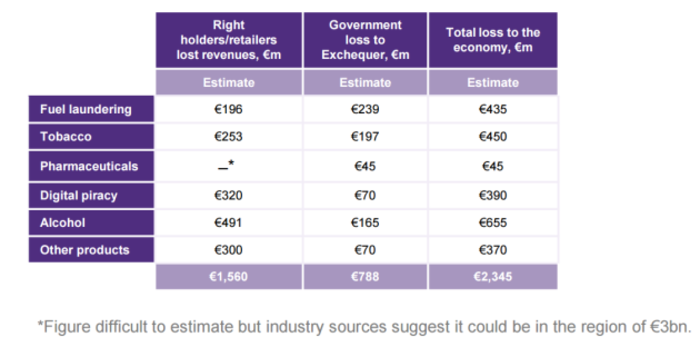

A new report from consultants Grant Thornton said the billion-euro loss to the economy was comprised of nearly €800 million in potential tax revenues, with retailers and intellectual property holders missing out on up to a further €1.5 billion.

Partner Brendan Foster said the unabated rise of illicit activity on these shores was “quite remarkable” and the cost of pirated media content was particularly concerning as it cost retailers a potential €320 million in annual revenue.

“We are concerned that the extent of illegal downloading of content continues to impact the industry heavily and outdated legislation and enforcement activity does little to protect the sector,” he said.

Foster added that it is now “vital that all sectors impacted continue to invest in public awareness campaigns to remind consumers that illicit activity is far from being a victimless crime”.

Click here for a larger version

Minimum unit pricing

The report commended the measures taken to address illicit activity costing the Irish economy, however it warned that the introduction of minimum unit pricing (MUP) for alcoholic products could have a negative effect.

The Public Health (Alcohol) Bill announced last December by then minister for health Leo Varadkar revealed the details of proposed MUP that would see a minimum price of €1 per unit of alcohol.

Although the measures are aimed at reducing consumption of alcohol, the report noted concerns that MUP will drive further illicit trade activity as consumers look for cheaper products.

Alcohol smuggling had the greatest net cost to the economy, Grant Thornton said, at €655 million each year from lost revenues and taxes.

The price of alcoholic drinks in Ireland is more expensive, on average, than any other country in the EU except Finland, mainly due to high excise rates.

Tobacco excise

In its report, Grant Thornton also highlighted that the excise yielded by the exchequer on tobacco has decreased by over €300 million since 2010.

While increased taxes on cigarettes has caused a reduction in smoking levels, the report suggested that continuing to increase the excise will strengthen the illicit trade of tobacco and also decrease overall revenue for the exchequer.

Click here for a larger version

Revenue last year seized almost 68 million illicit cigarettes and more than 2.3 tonnes of tobacco with a combined value of more than €35 million.

Nearly 46,000 litres of alcohol, worth around €600,000 was also taken in. The combined value of the contraband was up almost 20% on the 2014 tally.

Better enforcement

Other key findings from the report include:

- Digital piracy – It was estimated that retailers lost out on over €300 million in revenue due to illicit activity

- Alcohol – There has been a 100% increase in seizures made by authorities between 2010 and 2014

- Fuel – The carbon tax introduced in the solid fuel sector has resulted in an increased level of coal smuggling between the north and south of Ireland

Overall, the report called for better enforcement and new legislation to help combat the increase in black market trade.