Hotels enjoyed another year of growth - but it looks like the fun's over

There’s likely to be a ‘resistance’ to price increases so hoteliers will have to cut down their rising costs.

THE HOTELS INDUSTRY recorded another year of bumper sales and profits – but the fun could be over for the trade as it grapples with rising costs and Brexit.

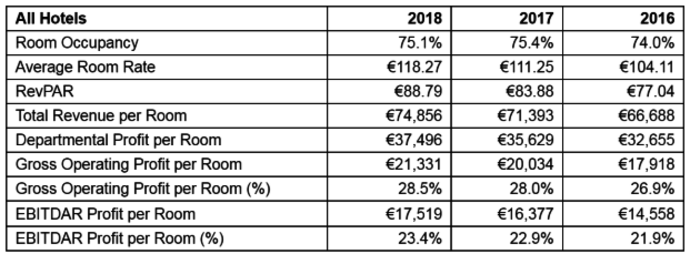

The latest annual review of the hotels sector by accountancy firm Crowe found that the industry reported its eighth consecutive year of growth in relation to turnover in 2018 while profits and room rates were up across the country.

However, the author of the report, Aiden Murphy, has said that last year marked a “turning point” for the industry as the rate of growth slowed in the face of increased costs, a bumpy sterling-euro exchange rate and Brexit uncertainty.

Crowe’s report found that hotel profits increased at a rate of 7% last year, the lowest level in seven years and a far cry from the 12.5% growth recorded in 2017.

“The cost base for hotels is rising faster than the revenue. While there were some signs of that in 2017, there were greater signs of that in 2018,” Murphy told Fora.

“The concern for 2019 is that if that trend continues, then it’s only the most efficient of operators and the operators that are most focused on cost control that will be able to push their profits forward over the next year or two.”

Click here to view a larger version

Rising costs

Murphy said that the three main categories of costs for hotel operators – utilities, insurance and payroll costs – each increased in 2018.

According to Crowe’s review, insurance premiums alone grew at a rate of 10% when revenues were up by just 5%.

Murphy suggested that insurance premiums for hospitality businesses are affected by compensation claims from both guests and staff. He also said there are fewer providers willing to insure leisure businesses, which makes it more difficult for firms to shop around.

When asked how these rising costs might affect customers, Murphy said hotels will likely review their menu and beverage pricing and try to increase charges wherever possible.

However, he noted there will be a general “resistance to price increases” so operators should focus more on reducing their costs over the next two to three years.

The hotel sector is heavily dependent on both the domestic and UK customers, which means Brexit is likely to play a big part in how hoteliers perform this year. Businesses will also have to deal with a higher VAT bill after the levy’s rate increased from 9% to 13.5% in January.

When asked what impact other accommodation providers, such as Airbnb, are having on the sector, Murphy said hotels remain the dominant provider of paid-for accommodation.

He said the main concern over the coming years may be the growing number of student accommodation available in key urban markets such as Dublin, Cork and Galway.

“If that student accommodation becomes available over the summer months for tourists, that could have a diluting impact in terms of what rates can be achieved by hotels,” he said.

Get our Daily Briefing with the morning’s most important headlines for innovative Irish businesses.