European startup investment is drying up - but Irish firms are taking more than their share

Overall VC funding for the continent has dropped to the lowest level in nearly two years.

THE AMOUNT OF investment being pumped into European startups has plunged to the lowest level in nearly two years, according to a new analysis.

However in an encouraging sign for fast-growing Irish firms, local venture-backed companies sucked up a disproportionately large share of the funding on offer in the most recent period.

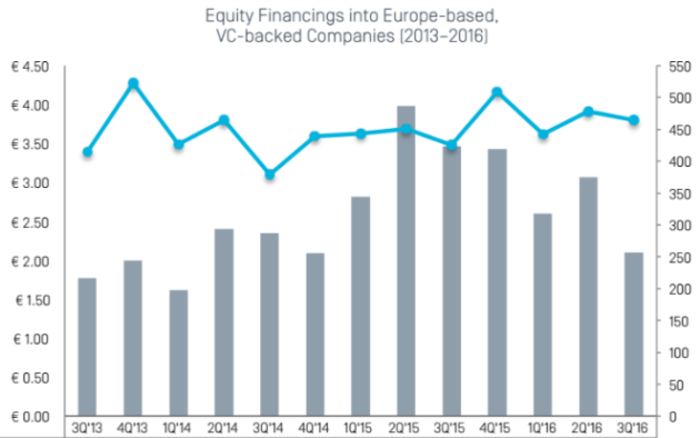

Third-quarter figures from Dow Jones VentureSource showed the total funding put into European venture-backed companies dropped 46% on the previous three-month period to €2.1 billion.

That amount was also a significant decrease compared to the same period last year and the lowest tally for the quarter since 2013.

VC investment in €bn/deals

VC investment in €bn/deals

Similarly, the total raised by venture capital (VC) funds was the lowest in two years – pointing to the likelihood that startup investment in the region will continue in a relative lull.

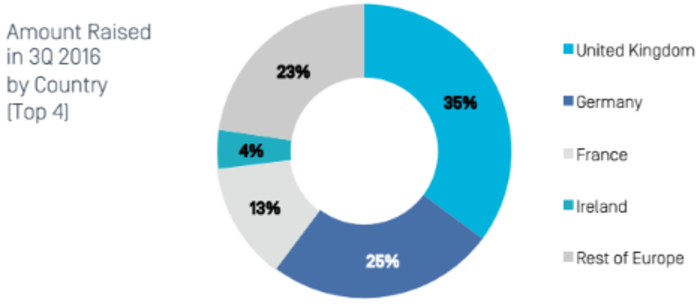

Ireland accounted for 4% of all VC investment in the latest quarter, the report said, the fourth-largest share of all countries in Europe – although it was well behind the UK, with 35%, Germany, 25%, and France, 13%.

Figures from the Irish Venture Capital Association have also shown record amounts of money being pumped into Irish companies – although, as previously detailed on Fora, the stats are often skewed by large investments in firms with tenuous links to Ireland.

Separate figures from Tech.eu, published last week, also showed a significant decline in Europe-wide investment with the lowest total raised since the start of 2015.

Major deals

US-headquartered SOSV, which was set up by Irish-American investor Sean O’Sullivan and has significant operations in Cork, was one of the most active investors in European firms with eight completed deals for the quarter, according to the Dow Jones report.

The UK was home to the largest deal for the quarter, a $275 million investment in London-based Deliveroo.

‘Consumer services’ firms attracted the biggest share of funding, taking in 37% of the total amount invested, while business and financial services took the next-largest portion with 22%.