Here's why Ireland is afraid of the EU's new corporate tax plans

The government is likely to object to the European Commission’s proposed rules.

CONSOLIDATED TAX BASE. Three words that are almost guaranteed to strike fear into the hearts of business and political leaders across Ireland.

Tomorrow, the European Commission is set to propose legislation for a common consolidated corporate tax base.

There has been a lot of disquiet about it in Irish circles, particularly among the government. Fine Gael MEP Brian Hayes recently told the Irish Examiner that the proposal represents a “creeping singular approach to tax coordination policy”.

Here are the key things you need to know about the EU proposals, why they are important and why they matter to Ireland.

What is this proposal?

The EU Common Consolidated Corporate Tax Base (CCCTB) is a single set of rules that companies operating within the EU could use to calculate their taxable profits.

Under this structure, a company would have to comply with just one EU system for working out its taxable income, rather than looking at different rules in each EU member state in which they do business. This would establish a common ‘base’.

Companies with operations across several different member states would be able to file one single single, ‘consolidated’ tax return with one administration for their entire activity within the EU.

On the basis of this tax return, any tax paid by the business would then be shared out amongst the member states in which it is active.

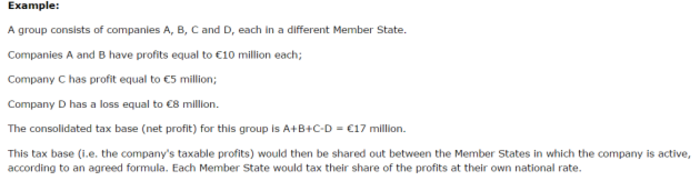

An example of how the 'consolidated' tax base would work

An example of how the 'consolidated' tax base would work

Why are they being introduced?

The proposals are widely viewed as a way of clamping down on tax avoidance by large multinational companies.

At the moment, businesses can use mismatches in the laws of individual countries to move around their profits. Companies can move their profits from a high tax jurisdiction to one with lower or negligible taxes, such as Ireland or Luxembourg, and minimise its tax bill.

This is done by a couple of different methods, such as transfer pricing (something that was previously explained in more detail by Fora for those interested). It has been estimated that aggressive tax planning costs EU member states between €50 billion and €70 billion in foregone tax revenue per year.

The new rules would make it more difficult for companies to move their profits between countries, and many methods of doing so, such as transfer pricing, would likely be largely eliminated. It is hoped that this would make taxes easier to collect.

Why is this in the news now?

Similar rules were originally proposed in 2011, but were shot down, largely due to opposition from countries such as Ireland and the UK.

In recent years there has been an increased focus in the EU on tax avoidance among large multinational companies, particularly with the LuxLeaks revelations and the EU Commission’s recent order to Ireland to collect €13 billion in unpaid taxes from Apple.

EU Competition Commissioner Margrethe Vestager

EU Competition Commissioner Margrethe Vestager

The proposals have now been revived and tomorrow the European Commission is due to propose legislation for a consolidated tax base.

The rules are largely the same. However, while initially it was proposed that the rules would be imposed on multinational companies on a voluntary basis, they will now be mandatory.

The EU has also said that the proposals will be broken into two steps. It said the first would see the common tax base introduced, while consolidation, where taxes would be paid on an EU basis, will be introduced “once the common base is secured”.

What does Ireland think?

Ireland is likely to strongly oppose the rules. Countries will still be able to set their own tax rates under the rules, and the EU has said that the proposals are not a first step towards a harmonised EU tax rate, where profits would be taxed at the same rates across the bloc.

However, this is exactly what Ireland fears. Some think that if the consolidated base is introduced, a single tax rate could follow as many EU countries are known to take a dim view to Ireland’s low 12.5% rate.

This could be hugely damaging for Ireland, which relies heavily on its low corporate tax offering to attract foreign investment.

Even the idea as proposed would be likely to reduce Ireland’s corporate tax take. If a company was to file a ‘consolidated’ return, few would be likely to have large sales in Ireland.

At the moment, many big multinational companies are moving lots of money through Ireland. This is one of the factors that has contributed to a recent surge in corporate tax receipts, which are increasingly being relied upon by the state.

If the consolidated base was introduced as envisaged, it is likely that Ireland’s corporate tax take would be cut.

When originally floated, Ireland and the UK both vetoed the proposals. However, as the UK has voted to leave the EU, it is thought that Ireland could now be politically isolated in its opposition to the plans.