Irish businesses should get ready for a 'fundamentally changed' deal with the UK

The economy is expected to take a hit after the Brexit vote, but no one knows what the full fallout will be.

IRISH BUSINESS LEADERS are calling for stability in a time of upheaval as the country’s key trading partner plots its exit from the EU.

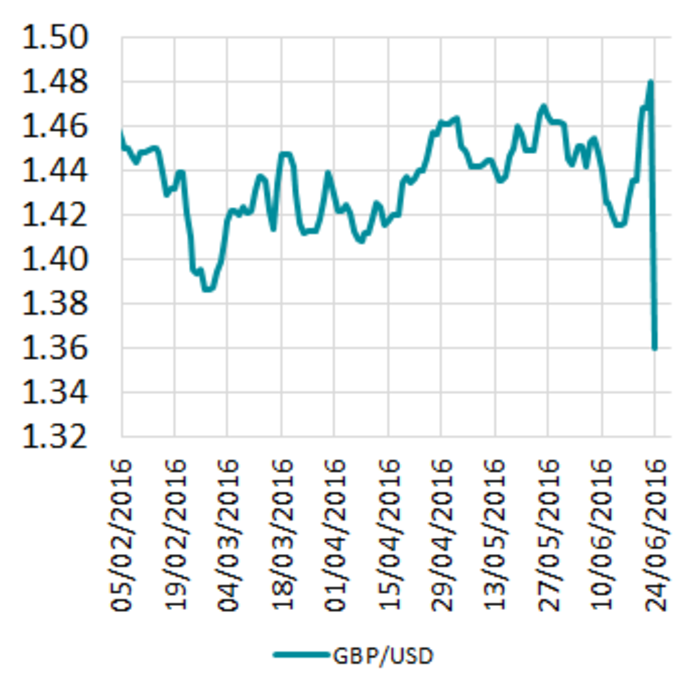

While currency and share markets were in a state of flux this morning following the UK’s Brexit vote, the full economic impact for the Republic could take years to emerge.

In a briefing note, Davy chief economist Conall Mac Coille said the UK decision probably wouldn’t be enough to push Ireland into recession, but it could drive the Republic’s GDP down as much as 2% this year and the next.

The crashing value of the pound is going to be one of the biggest factors as that new low price takes its toll on exporters.

“At this stage, quantifying the negative shock on consumer and business confidence is impossible,” Mac Coille said.

“However, Irish households and companies are still saving, rapidly paying down debt. So (they) are unlikely to cut back on spending and increase their savings from already high rates. That said, uncertainty could delay the fledgling recovery in spending by domestic companies and households.”

The ESRI previously predicted trade between Ireland and the UK could drop 20% in the case of a Brexit vote, although there won’t be any major changes to existing arrangements until the end of the two-year period for an EU exit set out under the Lisbon Treaty.

However there have been dissenting voices that argue an EU without the UK will present an opportunity for the Republic as the only English-speaking nation in the group.

Economist Constantin Gurdgiev had this verdict on Ireland’s prosperity in the EU over the longer term:

Time for pragmatism

Ibec CEO Danny McCoy said Ireland “will be impacted more than other countries by the UK’s decision to leave”.

“It is important that acrimony quickly gives way to pragmatism and that a speedy, mutually beneficial arrangement between the EU and UK is reached,” he said.

“Whatever the outcome … the vote will fundamentally change our relationship with our nearest neighbour and most important trading partner.”

Global share markets have also been suffering this morning with Ireland far from spared from the carnage.

Companies particularly susceptible to currency fluctuations and the UK market were the hardest hit, with Bank of Ireland shares down more than 40% at one stage.

Meanwhile, tourism is one of the indigenous industries most exposed to UK customers and this morning the Irish Hotels Federation warned there was a risk economic uncertainty and weaker sterling could have an impact on the country’s largest source of visitors.

Major implications

Food and drink producers are also among those with the most to lose from a Brexit and Irish Farmers’ Association president Joe Healy said minimising uncertainty and setting out a clear strategy for Ireland was key.

“The outcome of the UK vote has major implications for Irish agriculture and the agri-food sector,” he said.

“The government must give a clear signal that the issues of major importance to this sector, our trading relationship with the UK and Northern Ireland and the EU budget, will be central to the EU-UK negotiations.”

The British Irish Chamber of Commerce said it would be campaigning for the continuation of the long-standing common travel area between Britain and Ireland as well as a quick trade deal between the UK and EU.

Deloitte’s Brendan Jennings said there were positives to be had from a Brexit for some sectors, particularly the financial industry.

“We know that many financial services organisations in the UK have already identified an overdependence on the UK as a centre, and will be looking at the locations of their operations in that context,” he said.

“Ireland is a flexible, competitive and highly skilled economy and an attractive place to do business – something that can play to our advantage as internationally mobile business considers its options in the post-Brexit world.”