Your crash course in... How the Bank of England's stimulus package could hurt Ireland

Here’s the lowdown on the UK’s interest rates cuts and other measures.

AFTER WEEKS OF build-up to the Bank of England’s announcement about how it is going to deal with Britain’s vote to leave the EU, we finally have an answer.

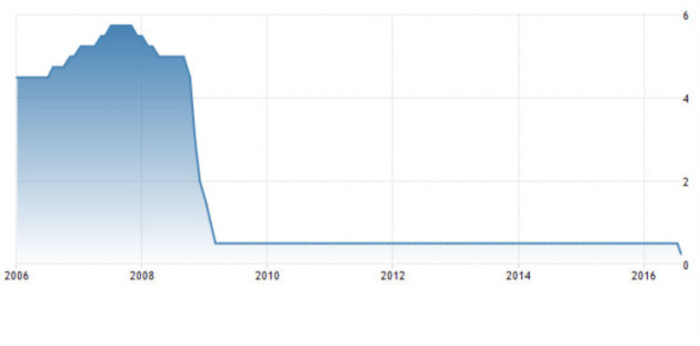

The nine-strong monetary policy committee today announced a host of measures to fend off a potential recession, including a move to cut UK interest rates to 0.25% – a record low for the world’s fifth-largest economy.

This is the first time in seven years that the Bank of England has cut interest rates and it represents a major move from the bank to try and prevent a downturn due to Brexit jitters.

Considering the deep ties between the UK and Irish economies, we’ve decided to break down exactly what the central bank’s decisions will mean for business here.

The UK interest rate

The UK interest rate

What is the Bank of England doing – and why?

To sum it up simply, the UK central bank was fairly confident a big recession was around the corner, so it took drastic action. It went as far as to say a downturn would have happened if it didn’t make a move.

Since Britain voted to leave the EU earlier this summer, there has been a lot of speculation that its economy would go south – with forward-looking indicators pointing to a major slump.

In a bid to stop a downward cycle before it takes hold, the central bank decided to roll out incentives to encourage lenders to lend and borrowers to borrow.

Lower interest rates will be good news for those in Britain that have variable-rate loans as they can expect to see their monthly repayments to fall – while those considering finance could be more likely to take the plunge if the costs involved are lower.

However, cutting interest rates wasn’t the only major decision the bank’s monetary committee made today. In another move to encourage lending, it also announced a new programme worth £100 billion to incentivise banks in the UK to hand out money to businesses and consumers.

Plans were also announced to boost a quantitative easing programme – which essentially involves creating new money out of thin air - by £60 billion to £435 billion. In simple terms, this means that the central bank has bolstered its own kitty for buying government bonds.

It has also created another £10 billion to buy corporate bonds – debt issued by UK companies – a move it hopes will also stimulate spending and the economy as a whole.

Nevertheless, the Bank of England still reigned in its medium-term growth forecasts in a significant way. Last May, the bank predicted GDP growth of 2.3% next year, but that forecast has now been slashed to an anaemic 0.8%.

Bank of England governor Mark Carney

Bank of England governor Mark Carney

How it affects Ireland?

Since Ireland’s economy is so heavily tied to our close neighbour across the sea, positive or negative results of the stimulus package on the British economy will likely filter through to Ireland.

To put in perspective how reliant Ireland is on Britain, two-fifths of all agri-goods in Ireland were shipped to Britain last year.

That’s not all. Ireland’s tourism sector is also heavily dependent on visitors from the UK, with nearly 4.5 million tourists from the Britain visiting Ireland last year and spending almost €1 billion.

Any downturn in the UK is likely to have flow-on effects for business here, but one of the greatest risks from the Bank of England’s moves will come from how they affect the sterling exchange rate.

The pound has already weakened significantly in the aftermath of the announcement and, if it continues to fall, it could result in less tourists jaunting across the Irish Sea for a holiday while making it move expensive for Irish exporters to sell goods into a key market.

Even before today’s announcement, Ireland’s largest business lobby group, Ibec, said that Ireland is in the midst of a “full blown currency crisis” due to the ramifications of Britain’s decision to leave the EU.

Businesses along the border are particularly exposed, as in many cases their customers have the easy option of heading North for relatively cut-price deals. On the flip side, Irish consumers – and some of the local traders that depend on them – could win out as all their UK-imported goods become cheaper.

The euro-pound exchange rate

The euro-pound exchange rate

What’s the reaction been?

In the immediate aftermath of the English central bank’s announcement, Chancellor of the Exchequer Philip Hammond welcomed the decisions, while bank governor Mark Carney hinted that further rate cuts could come in the next few months.

However the committee wasn’t unanimous on all the decisions it made to stave off recession. Although all nine members were in favour of the interest rate cut, three opposed the quantitative easing measures and one voted against the plans to buy corporate bonds.

Even though Carney admitted that interest rates will probably drop further in the near future, at a press conference this afternoon he ruled out slashing rates all the way down to 0%.