'A dog who won't bark, never mind bite': Central Bank under fire over the tracker scandal

More than 20,000 people are impacted – and numbers are likely to rise.

THE CENTRAL BANK was in the firing line of the Oireachtas Finance Committee today – described as “a dog that is refusing to bark, never mind bite” in relation to the tracker mortgage scandal.

Central Bank Governor Philip Lane said 11 of the 15 institutions under its remit had been involved in the activity, which involved lenders either denying customers trackers when they were entitled to one or charging them the wrong rates.

“I don’t believe all lenders happened to make the same mistake at the same time, ” Fianna Fáil’s Michael McGrath said.

He described it as “one of the greatest consumer rip-offs in our State’s history”.

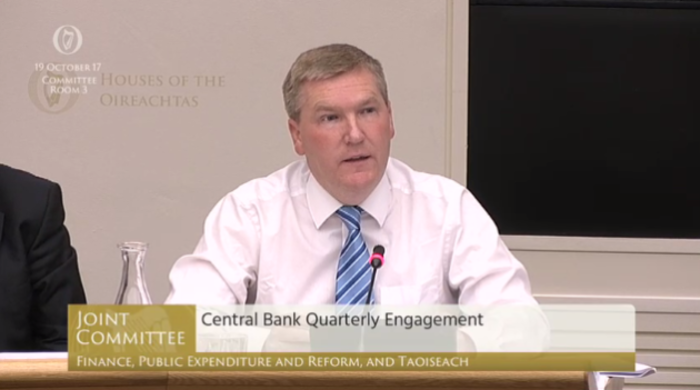

Fianná Fail's Michael McGrath

Fianná Fail's Michael McGrath

Figures supplied by the regulator earlier this week revealed 13,000 accounts were impacted by the scandal.

Some 7,100 Permanent TSB and Springboard accounts had already been identified prior to the current examination, which puts the total above 20,000. Lane said today he believes there are “substantial numbers” in addition to that figure.

In its latest update, the Central Bank said it had run into issues with the redress and compensation schemes proposed by the banks as they were not offering enough to customers they had harmed.

In the case of two institutions, the regulator also found “populations” of customers who it believes are impacted but who have been told by their bank that they are not. These two lenders have been told to go back and look at those accounts again.

Central Bank governor Philip Lane

Central Bank governor Philip Lane

Today Lane said the regulator has had to “repeatedly challenge” lenders to push them to identify and remedy the problem.

He said this is why the process taken so long thus far. Central Bank powers introduced in mid-2013 allow the regulator to compel lenders to pay redress to customers.

However Lane said the powers weren’t retrospective and much of the damage in relation to tracker mortgages was done before 2013.

He said the focus now is on persuading banks it is in everyone’s best interests for them to offer redress and compensation before going through other lengthy and expensive processes. This is working in some cases, but in others the lenders are not budging.

The Central Bank's Derville Roland

The Central Bank's Derville Roland

Derville Rowland, the Central Bank’s director general of financial conduct, said in cases where customers are excluded from the current process their lenders will still be required to issue notification.

They will be compelled to inform these customers that while they were deemed not impacted, they can pursue the matter through the Financial Services Ombudsman or the courts.

She said the regulator had seen the “devastation” this scandal had caused. However, she said it is restricted in what it can force the banks to do.

Sinn Féin's Pearse Doherty

Sinn Féin's Pearse Doherty

However Sinn Féin’s Pearse Doherty described the Central Bank as “a dog that is refusing to bark, never mind bite”.

The committee’s chair John McGuinness said: “The banks treat you like someone who can be pushed around.”

Lane repeatedly told members that decisions in relation to redress and compensation are for the banks to make and pointed out that it was the lenders that had caused the damage.

John McGuinness

John McGuinness

Lane said he did not believe there had been cartel-like behaviour at the banks, although he added there was a culture in the banks of interpreting ambiguities in contracts “in favour of making their own profitability higher, to the detriment of customers”.

The regulator confirmed it has met on two occasions with gardaí on the issue, but no formal report or complaint has been made.

Yesterday the Taoiseach said bank bosses will be hauled in by Finance Minister Paschal Donohoe early next week to answer for the scandal.

The Central Bank expects all lenders will have redress and compensation schemes in place by the end of this year, but it may be next year before many of the impacted customers see their money.

Written by Michelle Hennessy and posted on TheJournal.ie