The smallest businesses are being left behind as the economy recovers

Those that are reliant on only the domestic market are lagging the most.

THE SMALLEST FIRMS across the island of Ireland are lagging behind their bigger peers when it comes to enjoying a growth spurt from the recovering economy.

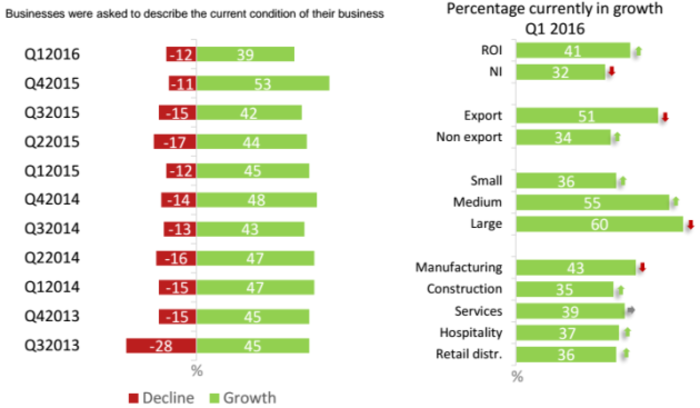

The latest InterTradeIreland business monitor, which polls more than 750 managers across the island, found only 36% of ‘micro’ companies – those which employed 10 or fewer people – were currently in growth mode.

That compared to 61% of firms with 50 or more workers reporting at least a slight rate of expansion, while more than half of that contingent said they were experiencing moderate to rapid growth.

At the other end of the spectrum, 14% of micro business were shrinking, barely surviving or being wound down, against only 1% of the larger employers.

InterTradeIreland strategy and policy director Aidan Gough said the figures supported the overall “cautiously positive” economic projections for both the north and south of the country.

Businesses that were exporting had a much better outlook than those trading in purely domestic markets, with more than half the first group reporting growth compared to only 36% of the latter.

“There still appears to be apprehension among businesses, both north and south, which have suitable goods and services for cross-border trading, to export or consider exporting,” Gough added.

Slow spending

Personal consumption in the Republic last year grew at less than half the pace of the wider economy, while government spending actually shrank, according to the CSO’s national accounts data.

The figures indicate that those businesses which are reliant purely on local demand will continue to lag behind exporters, although public spending is predicted to pick up slightly this year.

Gough said the latest survey results suggested that “unexpected external shocks beyond our control” still had the power to disrupt what was a good overall picture for businesses.

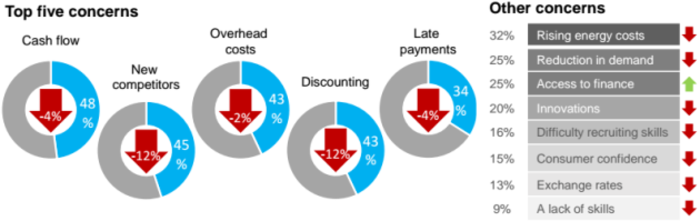

In other survey results, cash flow was identified as the most common concern of the managers polled, followed by new competitors, overhead costs and discounting.

Access to finance was the only increasing worry, while other problems like rising energy costs or the difficulty in finding staff with the necessary skills were in decline.