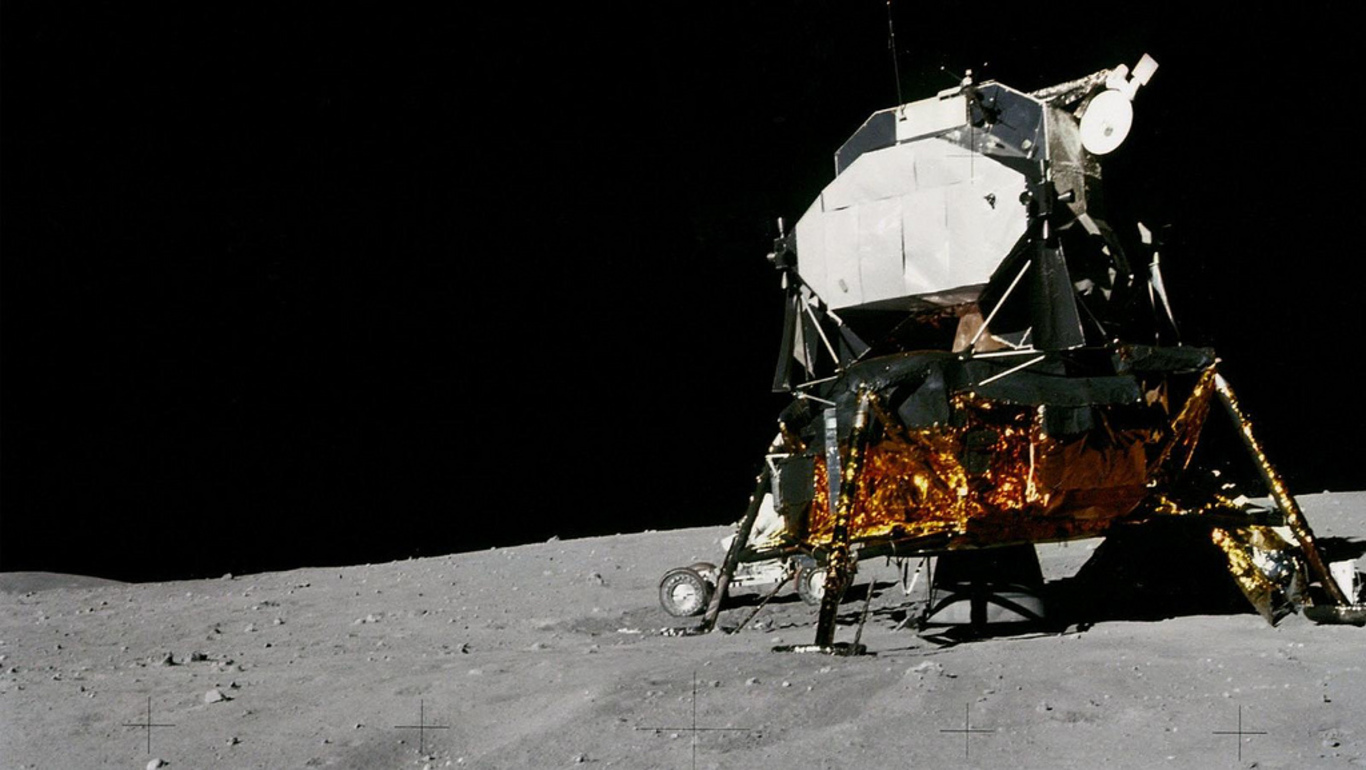

'We need real life forms in banks - not clean rooms akin to lunar modules'

Businesses are crying out for a bit of human contact.

NOT THAT LONG ago, there were a number of things to consider when choosing a bank.

The location, the interest rate, efficiency of the tellers and your relationship with the bank representative, manager or assistant manager, all played an important role in the decision-making process.

But now, with cheques deposited via machines and direct deposits, there is rarely a need to visit the teller. You’ll probably find there’s an evergreen plant where the teller used to be!

The manager is in a different town so you now have a relationship manager, a polite expression for someone who can’t spell relationship and isn’t available anyway.

The bailed-out banks, in their rush to recoup their traditional super-profits, have embraced automation and introduced ‘technological divorce’ to stop personal contact, while restructuring their banking halls into clean rooms akin to lunar modules bereft of humans, other than the bewildered advice-seeking customer.

Our own use of personal technology is also prompting the change in the traditional banking landscape. Increasingly, benefits such as bill pay, mobile banking and control over money transfers drive people to the online services provided by the banks and alternative providers.

But we are not totally ready for traditional banking to be replaced by a wider variety of financial vehicles.

There is a need for a customer-centric focus, different from the products-based business lines through which the banks currently organise themselves. These resultant silos have hindered the sharing of customer information between different units of the bank and have led to a reduction in service for the customer.

Blind to customer needs

Prior to and right up to the crash, the banks had sold products that were inappropriate to customers and had taken their eye off the ball, blinded to actual customer needs.

But before then, bank managers in the 80s and 90s were customer-centric, strict financial disciplinarians who understood risk and were able to lend based on their understanding of the customer’s life cycle, purchasing patterns, preferences and behaviours.

Additionally, the customer-centric view positioned the bank to potentially predict new demands in advance of the customer inquiries. In our most recent ISME bank survey, taken at the beginning of March, one of the questions asked was how you like to deal with your bank in loan applications.

Some 94% of respondents wanted to meet with a bank representative personally or over the phone while only 3% opted for online applications. So for SME owners, the personal contact is still important.

Two particular comments from SME business owners make the point eloquently:

“We were just an account number. Decisions were being made at bank headquarters. They didn’t know us as a customer. The fees have become too high for the services offered and they certainly don’t have their clients’ best interests at heart.”

“They abruptly ended a long-term relationship with us, a financially stable business that was seeking to minimise bank fees. They are a bank driven by undisclosed metrics and have no personal understanding of our business or relationship.”

We really need to get back to the basics of banking. The current CEOs of our banks must change the new culture and behaviours of their organisations. They must invest in customer service, staff training and regain the trust of their customers.

Let’s start with the reintroduction of real life forms in branches and real relationship managers who know what they are doing.

Mark Fielding is the CEO of the Irish Small and Medium Enterprises Association (ISME).

If you want to share your opinion, advice or story, contact opinion@fora.ie.