The 'stupid parlour tricks' from a Silicon Valley superstar that will fix your business pitch

The head of a global accelerator delivers a masterclass in fine-tuning a presentation for investors.

ENTREPRENEURS MAKE ROOKIE mistakes all the time when they’re pitching. I should know – I’ve worked with a few thousand of them.

Usually it takes somewhere in the order of 15 to 20 iterations before an entrepreneur has a pitch deck that’s ready to be presented to potential investors.

I think that’s because a lot of startup founders try to be a bit too creative in compiling data for the people on the other side of the table. In reality, you need to be very uncreative and matter-of-fact.

Summarise your business

One of the biggest problems that most entrepreneurs face is that they have a difficult time summarising their business so that investors can understand it.

The first thing I recommend to every entrepreneur is that they open their pitch by explaining their startup in a single sentence.

A lot of founders complain that their business is so complicated that they need five or 10 minutes to explain it. That’s not true. I’ve never heard of a business that couldn’t fit into that one-sentence format.

All great companies start out with a very focused purpose. For example, Facebook was built for Harvard University students so they could communicate with one another without leaving their dorms.

Facebook CEO Mark Zuckerberg

Facebook CEO Mark Zuckerberg

Before you give investors the details of your idea, they need to understand the basics of what you do.

The Founder Institute has created a template for how to summarise your startup in a single sentence, which will help get you started if you’re struggling.

Presentation style

Once you’ve got your one-sentence pitch out of the way, you need to think about how to present the overall idea.

There are four pretty basic ways you can package your business. I’m going to start with the two worst and explain why I don’t think they’re a good idea.

There’s the factual pitch, which is where you basically just go through the series of details about your business in some sort of sequence.

I don’t recommend doing that because you can put things out of order. You might want to talk about who’s on your team, but it might be a better idea to lead with the business idea.

You have to really be a skilled tactician if you want to go for the factual pitch.

Then you’ve got what I call a narrative pitch. That’s basically the life story of the company and how it came to be.

The problem with this one is that entrepreneurs tend to ramble and go off-topic. An investor doesn’t care about how you met your wife or when you had your first kid. They only care about your business.

A narrative pitch only works if you memorise a precise story and don’t present a long, tangential tale.

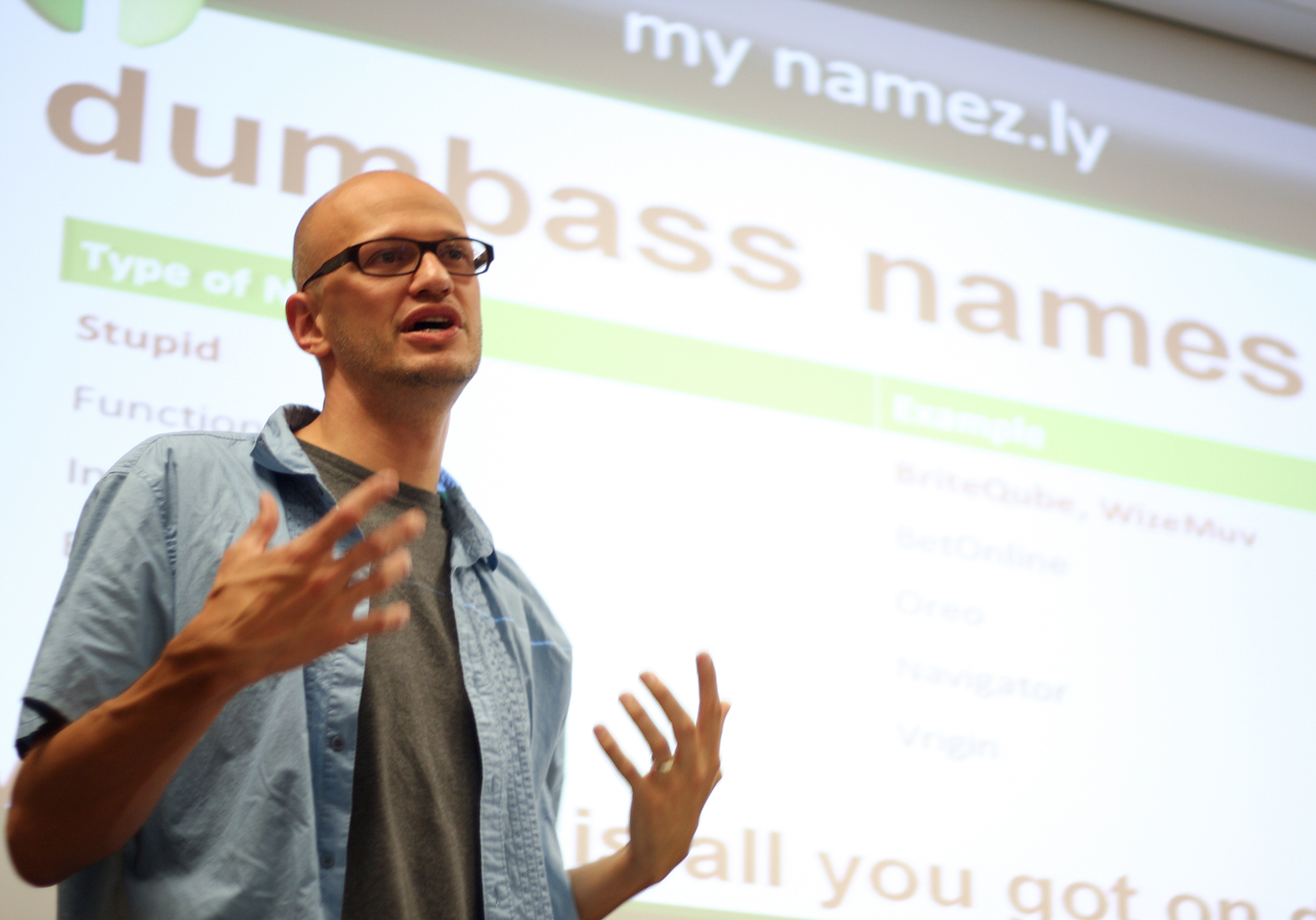

Adeo Ressi in Dublin

Adeo Ressi in Dublin

That leaves us with what I think are the two most effective ways of presenting an idea: the vision pitch and the problem-solution pitch.

A vision pitch tells the investor that you have a vision for how the world could be a better place and you’ve made something to make it come true.

For example, it could go something like: “I believe that millennials should have greater fulfillment in their working life and a more important purpose to their day job, so I have created X to do Y.”

The problem-solution pitch is where you basically present a series of problems and how your business is going to solve each of them: “Today, millennials spend an average of 300 hours searching for a job. They often make compromises on location, pay and type of work. We have a created a system to find them a job within a five-mile radius of their house…”

Even though the vision and problem-solution models are usually the best, it’s worth bearing in mind that there isn’t a one-size-fits-all presentation formula – people still screw up the vision and problem-solution style.

They’ll often have a vision and mix in some problems and solutions, or they’ll outline four problems but only one solution. If you present four problems, you need to present four solutions.

Avoid the obvious

One of the most common mistakes I see young entrepreneurs make is including obvious use-of-proceeds information in the ‘ask slide’ of their pitch deck – the part where they ask for the money.

If you’re fundraising, it’s a given that you’re going to pay salaries, rent office space and cover for legal expenses. You don’t need to put that in your slides. An investor might ask for that information, but it certainly doesn’t need to be in your pitch deck.

A strong ask should be super clear: “Right now we’re raising €500,000. We have €200,000 committed, and we’re going to be releasing a new product that we expect to triple our revenues. We’re looking for an investor that can participate at the €25,000 or €50,000 level.”

A startup office

A startup office

Another huge mistake I see entrepreneurs constantly make is forgetting to talk about their business objective in the ‘ask slide’.

You’re always raising money for your business objective, nothing else: “I’m raising money to get 100,000 paying customers. I’m raising money to close a deal with IBM. I’m raising money to triple our revenues from €100,000 a month to €300,000 a month.”

That’s your business objective. It’s not a product objective. You may want to combine the two and say something like, “I’m raising money to launch the next version of my product and secure 100,000 users.” But there is always a business objective.

Stupid tips

There’s a whole bunch of other stupid parlour tricks that entrepreneurs often overlook.

Here goes:

- Number the pages on a pitch deck

- Display confidence when you meet investors and don’t make excuses: “I’m tired, I didn’t sleep a lot, this is first version of my deck.” That’s just seen as a red flag for things to come

- Don’t use extreme adjectives and superlatives: “We’re the best, we’re the fastest, we’re unique, we’re the first, we’re revolutionary.” Let the investor decide that

- Use as much data as possible. If you say, “Large companies love us”, it’s meaningless. If you say, “50 of the top 100 companies in Ireland use our product today”, that’s much more credible

- Enunciate the company name. So many people mumble their names. When they do, I tell them I run THE FOUN-DER INS-TI-TUTE.

Adeo Ressi is the chief executive of The Founder Institute, a pre-idea accelerator and launch programme, which runs in 180 cities. It is currently taking admissions for its Dublin branch. This article was written in conversation with Conor McMahon as part of a series of masterclasses with some of the most influential people in business.

If you want to share your opinion, advice or story, email opinion@fora.ie.