Nama lost €800m on its Project Eagle portfolio as part of a 'seriously deficient' sale

The bad bank wasn’t able to show the state got value for money on the deal, a new report says.

THE DÁIL PUBLIC Accounts Committee (PAC) has published its report on the sale of Nama’s northern Irish property portfolio - otherwise known as Project Eagle – declaring the process “seriously deficient”.

Nama lost a total of €800 million on the loan portfolio between the years 2010 and 2014.

The state bad bank had taken on the loans – which had a face value of €5.38 billion – at a more than 50% discount, with the original purchase costing €2.65 billion.

However the eventual sale to so-called vulture fund Cerberus Capital Markets in 2014 netted just €1.43 billion. It has been claimed this deal may have undervalued the assets by more than €200 million – resulting in taxpayers being shortchanged.

The sale of the portfolio has been a source of mounting controversy for several years, although Nama has consistently disputed forgoing any potentially higher proceeds from the deal.

In a statement today, a Nama spokesman said the Cerberus sale “provided a better financial outcome than any alternative monetisation strategy”.

He added that the losses arising from the portfolio since its acquisition would have occurred regardless of whether the loans were sold in 2014 or retained as the Northern Ireland property market remained “challenging”.

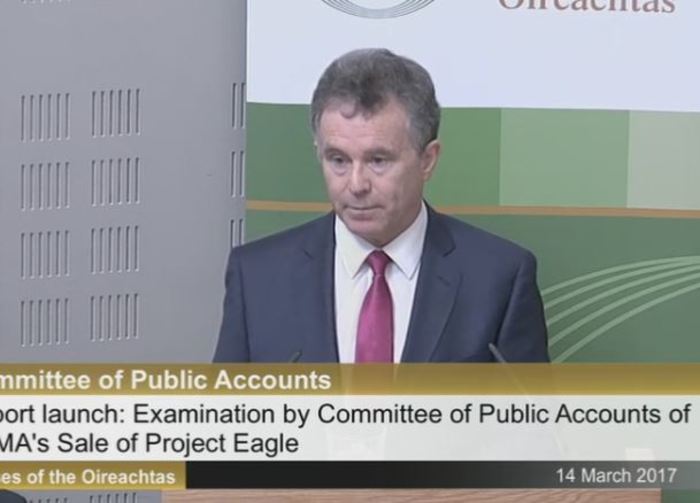

Fianna Fáil TD Sean Fleming announcing the publication of the Nama report this afternoon

Fianna Fáil TD Sean Fleming announcing the publication of the Nama report this afternoon

The report today said:

- That the sale of Project Eagle was not “a well-designed sales process”

- The failure to remove controversial businessman Frank Cushnahan from the agency’s northern advisory committee was “a failure of corporate governance” (Cushnahan resigned from the committee in November 2013 citing “personal reasons”)

- Nama’s board was not explicitly informed of the losses that could be incurred by setting a reserve price of £1.3 billion for the sale in 2014

- Key elements of the sale were “influenced” by the US firm Pimco, which made the initial approach to Nama with regard to the sale of the portfolio

- The sales strategy regarding the portfolio included “restrictions of such significance” that the process could be described as “seriously deficient”

- Nama has been unable to demonstrate that it got “value for money” in the sale.

Pimco backed out on the purchase before the eventual sale to Cerberus, revealing it had discussed a £15 million ‘success fee’ for Cushnan and law firms Brown Rudnick and Tughans.

The eventual winning bidder paid the same sum to the two law firms after recruiting them to complete the deal.

The finance minister

The report also includes, among other things, a strongly worded letter from Minister for Finance Michael Noonan to the committee contesting its suggestion that his meeting in March 2014 with the US fund Cerberus (which eventually bought the portfolio in April 2014 for €1.6 billion) was “inappropriate”.

Noonan had sought a right of reply from the committee regarding its conclusions over his own actions. Today Noonan said he refuted “certain findings” of the report.

“I note that my letter has been included with the report. It is disappointing that unjustified and unfounded views have made their way into the final iteration,” the minister said in a statement.

Noonan said he “absolutely” refuted any suggestion he or his officials acted inappropriately in meeting with Cerberus in 2014.

“It is entirely appropriate that I, as minister for finance, would meet with the chairman of a major international investment fund, a former US secretary of the treasury no less, at his request whilst he was in Dublin on business. This is part of the job.”

Sinn Féin TD and committee member David Cullinane meanwhile said that “good judgement” should have shown that the minister’s actions were “procedurally inappropriate”.

It has been claimed that the Project Eagle sale undervalued the portfolio significantly and that taxpayers were effectively shortchanged on the deal.

The committee’s inquiry into the loan sale was first announced last July. A separate report from the Comptroller and Auditor General, meanwhile, released last September, concluded that the Irish state lost out on up to £190 million (€217 million at today’s rates) in the eventual sale.

Nama said no independent, market based analysis has been sought by or provided to the committee to back up the figure.

Note: This article has been updated to include a statement from Nama.

Reporting by Cianan Brennan, Peter Bodkin and Cormac Fitzgerald.