Study claims Irish workers need to be saving €1,000 a month to fund retirement

A study from Deloitte says that people need to start saving much more to maintain their living standards.

IRISH PEOPLE SHOULD be saving an average of €1,000 a month to maintain their living standards when they hit retirement age, a new study has claimed.

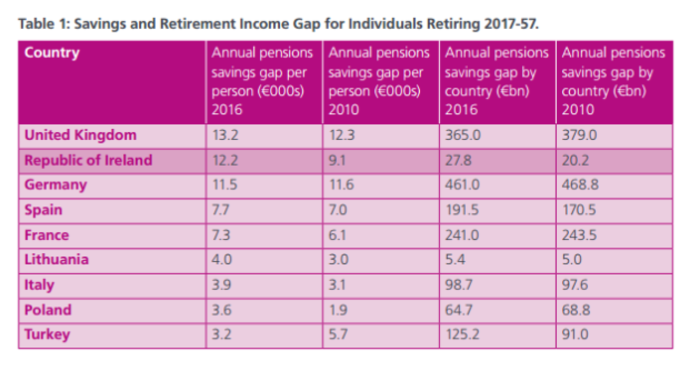

A report carried out by consultancy firm Deloitte on behalf of insurance company Aviva said that Irish people “need to save an additional €27.8bn a year to close the gap between current pension savings and the income needed to provide an adequate standard of living in retirement”.

It said that the size of the gap means that the estimated two million people currently working who will be due to retire between 2017 and 2057 “will have to save, on average, an additional €12,200 (gross) per annum or €1,017 gross per month.”

When asked for a breakdown as to how the figure was arrived at, a spokeswoman for Aviva told Fora that the €12,000 average “is measured across the full population which includes a majority of people who don’t contribute to any pension”.

The report said that the gross savings gap has increased from just over €20 billion in 2010 and is one of the highest of any country in Europe.

Per head of population, only the UK had a higher retirement savings gap, of €13,200 a year.

Young and old

Aviva said that the increase in the savings gap over the last number of years is likely due to several factors, including:

- People living longer.

- The fall in long-term yields due to low borrowing costs and interest rates internationally.

- The freeze of the state pension from 2010 to 2015.

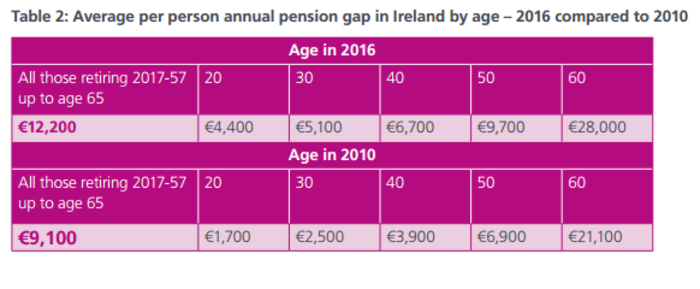

The report said that the size of the gap depends on a person’s age. “Younger workers face a smaller gap because they have more time to save for retirement but the gap has widened for all age cohorts over the last six years,” it said.

As expected those in their sixties face the largest gap: an average of €28,000 per year, up from €21,100 in 2010, while the gap for those in their twenties was found to be an average of €4,400, up from €1,700.

Living standards

The study assumed that people would need a “replacement rate” of 70%, the benchmark used by the OECD international think-tank. The replacement rate is how much a person needs to save to maintain a reasonable standard of living in retirement.

For example, if a person earns €40,000 a year and needs €32,000 a year after they leave the workforce, their replacement rate is 80%. If a person earns the same amount, but could maintain their desired living standards with €28,000, the rate drops to 70%, and so on.

The report points out that, generally, outgoings such as mortgages will have been substantially reduced or paid off and children will be less financially dependent by the time a person hits retirement age.

“This means that the level of income required to fund retirement will be lower than pre retirement,” it said.

The report said that it “confined itself” purely to retirement savings and did not take into account any non pension investments such as property that people may own.

It added that the property crash and financial crisis “clearly demonstrated how the value of assets (such as) property or investment can be rapidly eroded”.