The scary truth about pensions - it really pays to start early

Your retirement pot will halve for every decade you put off saving.

THE VALUE OF the average pension pot virtually halves for every decade workers put off saving.

While employees who start paying €300 per month into a pension at 25 will on average enjoy a retirement pool worth €800,000, the figure drops to €400,000 for someone who postpones their saving until 35.

Renewable energy fund Greenroom Investments compiled the figures for Fora as it released a survey showing two-thirds of people believed you should start a pension in your 20s.

The survey, carried out by iReach, revealed just over one-fifth of the 1,000 respondents thought the time to start saving was in your 30s, while 12% said you should begin in your 40s, 50s or 60s.

However the views were much less-widely held among young adults, with less than half of those aged between 18 and 34 believing their 20s were the time to begin a pension pot.

Greenroom director Michael Bradley said that many people are put off from looking at whether or not to start a pension by “the complexity of the topic”, highlighting the need for further education.

He added: “The Department of Social Protection has said for many years that they realise there is a need to simplify Ireland’s pension system.

“Just last year Minister Joan Burton said she knew that Ireland’s systems have become extremely complex and difficult to understand, but it seems that little has been done to address this”.

Pension value

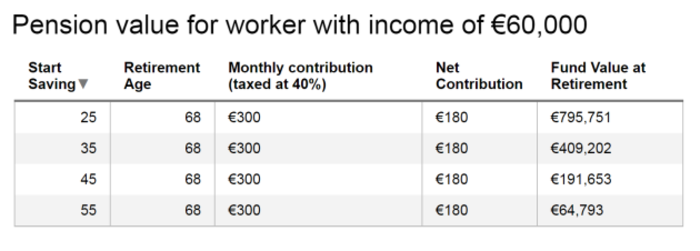

The figures compiled by Greenroom showed that those contributing €300 a month towards a standard pension from the age of 25 would have a pot of €795,751 by the time they reach the age of 68.

The fund’s calculations assume an average annual return of 6%, while it also factors in a 3% rise in the amount put aside each year.

However the retirement fund dropped to €409,202 by retirement age for those who started at 35, €191,653 for people who started at 45 and €64,793 when starting at 55.

How much of a pension you are entitled to receive from the state depends on how many PRSI credits you accrue. The credits are built up over years of work and a higher amount of credits will result in a higher state pension.

The highest payment people can receive from the state pension is €233.30 per week. The lowest weekly amount paid out by the State is €93.20 per week.