Here are the key leaks from the Paradise Papers - and why they matter

From Bono to Apple, scores of high-profile people and firms have had their offshore tax dealings exposed.

THIS WEEK – IN case you weren’t already aware – a trove of documents were released detailing how massive corporations and high-earning individuals move their incomes around the world to avoid paying tax.

Dubbed the Paradise Papers, they were first leaked to the German newspaper Süddeutsche Zeitung, which received 13.4 million documents from 120,000 clients of the Bermuda law firm Appleby.

According to the BBC, the name “Paradise Papers” was chosen because of the “idyllic profiles of many of the offshore jurisdictions whose workings are unveiled”, while also dovetailing “nicely with the French term for a tax haven – paradis fiscal“.

The documents were then shared with the International Consortium of Independent Journalists (ICIJ), leading to a series of stories about how companies move money around the world to avoid tax.

What’s important to note about the Paradise Papers is this kind of activity not illegal – those involved are exploiting a series of tax loopholes and many argue this is just being smart.

It does, however, shed a light on the private interests of the royals, celebrities, and companies and their operations, as well as spark a debate about whether more comprehensive anti-tax avoidance laws are needed.

It’s also sparked a debate about whether it’s moral to publish tax documents and legal advise indiscriminately, and whether the right to privacy lessens with the more money and influence an individual, or business, has.

Here’s a recap of the revelations that have come over the past week:

The Irish links

U2 frontman Bono was shown to own a stake in a Maltese company that in 2007 bought a Lithuanian shopping mall via another holding company, which may have broken tax rules by using an unlawful accounting technique.

The singer later issued a statement to say that he was “distressed” by the leaked documents. He said he had been “assured by those running the company that it is fully tax compliant”.

Apple and Google have both been asked to appear before the Public Accounts Committee next year following the Paradise Papers revelations.

According to the Guardian, documents show that Apple reacted to criticism of its tax affairs by secretly moving parts of its business to the island of Jersey, which charges zero corporate taxes.

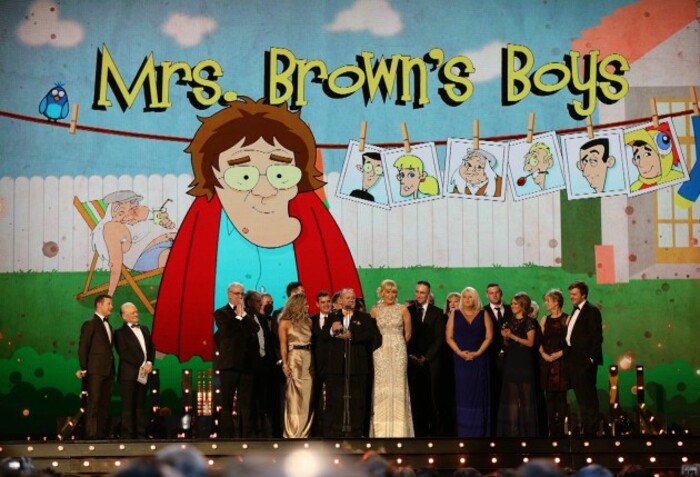

The cast and crew of Mrs Brown's Boys

The cast and crew of Mrs Brown's Boys

Meanwhile, the BBC reported that three cast members of Dublin comedian Brendan O’Carroll’s hit sitcom, Mrs Brown’s Boys, had diverted millions of pounds through a tax-friendly offshore scheme.

According to the British broadcaster – which airs the Bafta award-winning comedy – Patrick Houlihan and Martin and Fiona Delany had transferred more than £2 million in fees into a Mauritius-based trust and sent the money back as loans.

Fiona Delany is the daughter of O’Carroll and stars as Maria Brown on the show. Her husband, Martin, plays Trevor, while Houlihan plays Dermot Brown.

Houlihan gave an interview to the Irish Times, a partner of the ICIJ, in which he claimed he doesn’t understand the tax scheme used for part of his income.

The Irish Times reported that the Paradise Papers showed that many corporate activities by business tycoon Denis O’Brien are conducted through companies housed in the Isle of Man.

The self-governing island has a zero corporation tax rate and charges no capital gains tax nor stamp duty. The British crown dependency has denied it is a tax haven, and there is no suggestion that any of the structures reportedly used by O’Brien are unlawful. He hasn’t responded to the reports.

Politics

Queen Elizabeth II has, through the Duchy of Lancaster, which provides her income and handles her investments, placed around €11.3 million of her private money in funds held in the Cayman Islands and Bermuda.

The funds were reinvested in an array of businesses, including controversial rent-to-own retailer BrightHouse, which has been accused of exploiting the poor.

Her son, Prince Charles, has invested millions of pounds in offshore funds and businesses, including a Bermuda-based sustainable forestry company once run by a close friend.

The US Commerce Secretary Wilbur Ross holds a 31% stake in maritime transport company Navigator Holdings through a complex web of offshore investments.

Canadian Prime Minister Justin Trudeau.

Canadian Prime Minister Justin Trudeau.

In Canada, Prime Minister Justin Trudeau‘s top fundraiser and senior advisor Stephen Bronfman, heir to the Seagram fortune, moved some $60 million to an offshore haven in the Cayman Islands.

Brazil’s economy and agriculture ministers, Henrique Meirelles and Blairo Maggi, are also cited as using offshore companies in tax havens.

Celebrities

Radio France said Pop diva Madonna invested in a firm that gained from taxes on virtually non-existent capital gains.

Britain’s four-time Formula One champion Lewis Hamilton avoided paying taxes on a private jet, receiving a £3.3 million Vat refund in 2013 after it was imported via the Isle of Man, a low-tax British crown dependency.

Colombian singer Shakira, who lives in Barcelona, has been domiciled in the Bahamas for tax reasons and transferred €31.6 million earned in royalties to Malta, France’s Le Monde newspaper said.

Multinationals

US sportswear giant Nike used a loophole in Dutch fiscal law to reduce, via two companies based in the Netherlands, its tax rate in Europe to just 2% compared to the 25% average for European companies.

The taxi-hailing app Uber and the manufacturer of Botox, the Allergan pharmaceutical laboratory, allegedly used similar methods to Nike.

The Paradise Papers also revealed that Russian companies with links to the Kremlin invested hundreds of millions of dollars in Twitter and Facebook.

Written by Gráinne Ní Aodha and posted on TheJournal.ie. With reporting from AFP and Fora.