'Seriously insolvent' renewable energy group OpenHydro is headed for liquidation

The tidal energy outfit racked up debts of €280 million, the High Court has heard.

THE HIGH COURT has appointed provisional liquidators to two renewable energy companies that employ more than 100 people.

Justice Caroline Costello said she was satisfied to appoint Michael McAteer and Stephen Tennant of Grant Thornton as joint provisional liquidators to the Dublin-based OpenHydro Group Ltd and its subsidiary, OpenHydro Technologies Ltd, after being told both companies were “seriously insolvent” with debts of approximately €280 million.

The court agreed to the appointments after being told that OpenHydro’s French parent, which had invested €260 million in the firms, was no longer prepared to support the enterprises because the companies were loss-making.

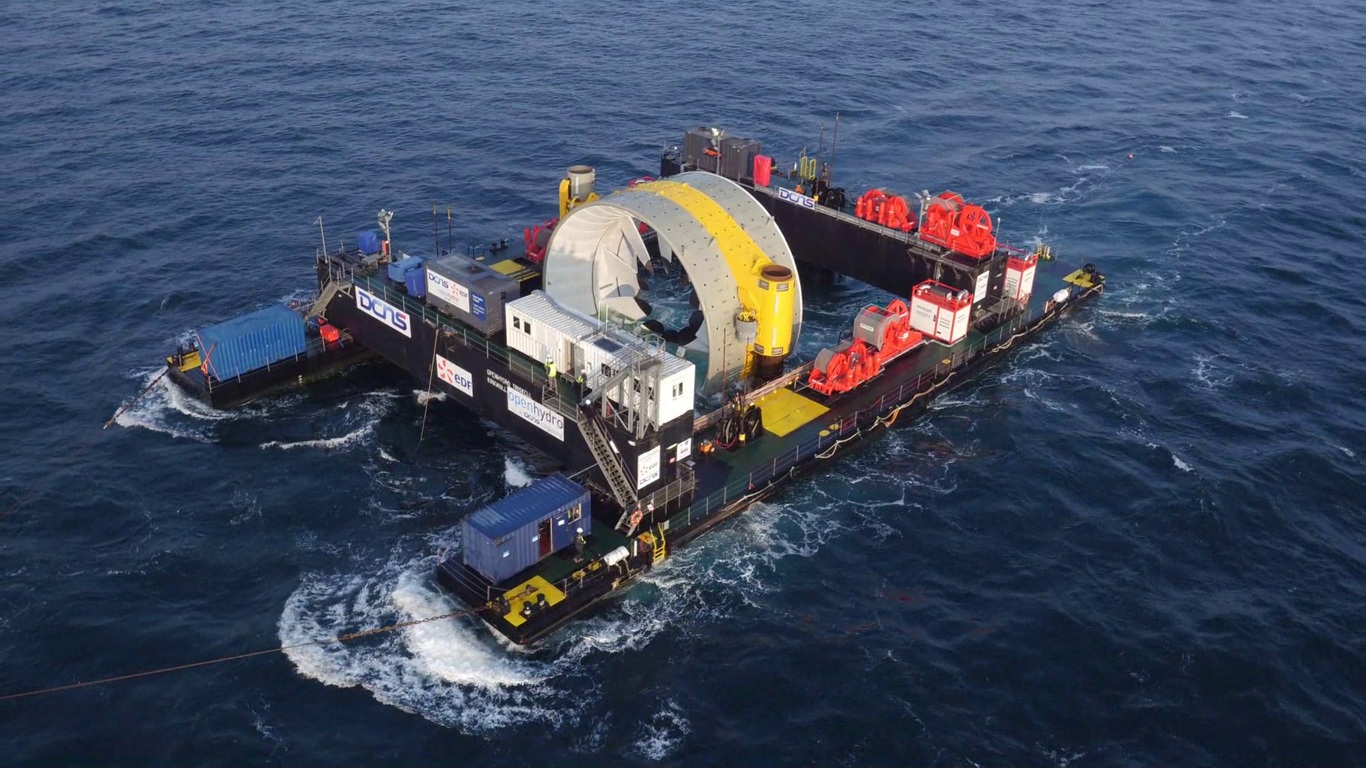

The group is involved in activities including the development of turbines which generate power from tidal energy.

The application to wind up the companies was made by Naval Energies, which the High Court heard is the largest shareholder and creditor of the OpenHydro group.

Rossa Fanning for Naval Energies said that on top of what the parent had already invested in the Irish group, it was projected that OpenHydro would make further losses of €128 million between now and 2026.

Challenging year

Counsel said that 2017 had been a particularly challenging year for the group.

During that period, OpenHydro – which has operations in Ireland, Scotland, Canada and Japan – had sustained approximately €160 million in losses.

It needed €1 million a week to survive. Naval Energies counsel said it had acquired the company in 2013 from those who established it in 2006.

Given the predictions about the group’s future income and expenditure, the parent firm was not prepared to advance any more money that would allow it continue to operate, counsel said.

In the circumstances counsel said that it was appropriate, given the complex structure of the group, that liquidators be appointed by the court in order to secure the assets worth in excess of €80 million.

Counsel said another factor supporting the application was that his client has received a communication from the group’s senior management which indicated that there had been a breakdown in relations between them and the board of directors.

He said that the group was not opposing the application to be wound up.

Justice Costello, after appointing Tennant and McAteer as joint provisional liquidators, adjourned the matter to a date in August.