'There's a lesson to be learned': Push to reveal details of Sugarman bank probe

The Central Bank is being pressed to make public its investigation into Unicredit breaches.

THE CHAIR OF the Oireachtas finance committee is pushing for the Central Bank to reveal exactly how it acted following a complaint from former Unicredit Ireland executive Jonathan Sugarman.

The move comes despite the fact that the Central Bank says it has thoroughly investigated the decade-old issue and the matter is now closed.

Jonathan Sugarman was the risk manager at Unicredit Bank Ireland in 2007. This was the Irish arm of Italian firm Unicredit, one of the largest banking and financial services companies in the world.

As previously explained by Fora, Sugarman resigned from Unicredit Bank after saying that the bank had breached its liquidity requirements on multiple occasions.

The Central Bank has previously said that it investigated the bank in October 2007. While it did discover a breach, it said it was satisfied that it did not suggest “a wider or more systematic erosion of overall liquidity”.

It said that Unicredit was back in compliance with the limits within 24 hours of the breach.

However, Sugarman has continued to campaign on the issue, calling for officials involved in his case and the banking collapse to be held accountable and receive sanctions.

Sugarman and Fianna Fáil’s John McGuinness, the chairman of the Oireachtas Finance Committee, today met with Central Bank governor Philip Lane to discuss the issue.

Following the meeting, the Central Bank released a statement confirming that Lane met with the pair – and reiterating that it considered the Unicredit matter closed.

However, both McGuinness and Sugarman feel that the issue remains unresolved.

“I reported a multi-billion euro liquidity breach a year before the Irish bank guarantee. Here we are 10 years later volunteering to explain further to the Central Bank what happened, and they don’t want to know,” Sugarman told Fora.

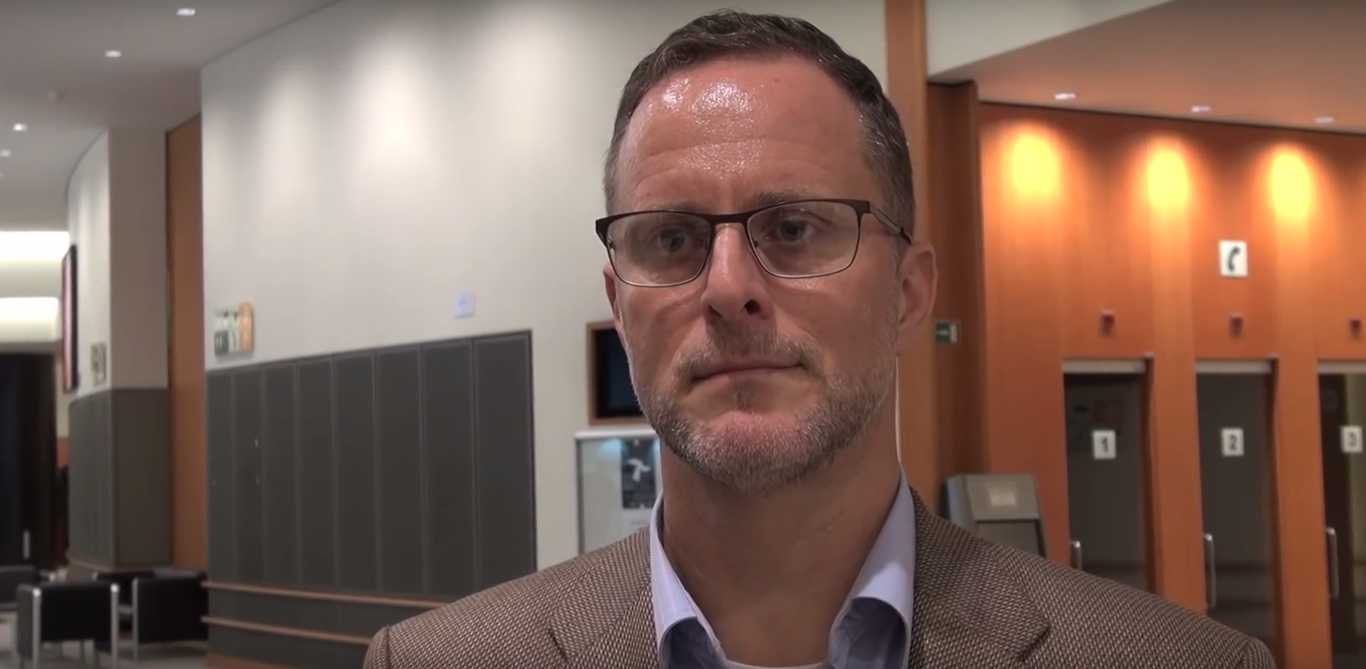

Sugarman and McGuinness outside the Central Bank

Sugarman and McGuinness outside the Central Bank

Finance Committee

McGuinness said that he will now raise the matter with the finance committee and will put pressure on the Central Bank to make public details of how it probed the Unicredit breaches after Sugarman contacted the regulator.

He said that this is important as it will give clarity as to whether the Central Bank acted appropriately when investigating Sugarman’s reports.

“This will be raised at the finance committee again at the earliest possible date, maybe next week,” McGuinness said.

“There is a lesson to be learned here, and there would be a greater lesson if the Central Bank took in Jonathan Sugarman and interrogated him on what happened.”