Poll: Do you think the new government will make Ireland better for business?

We look at some of the key measures being proposed under the administration’s plans.

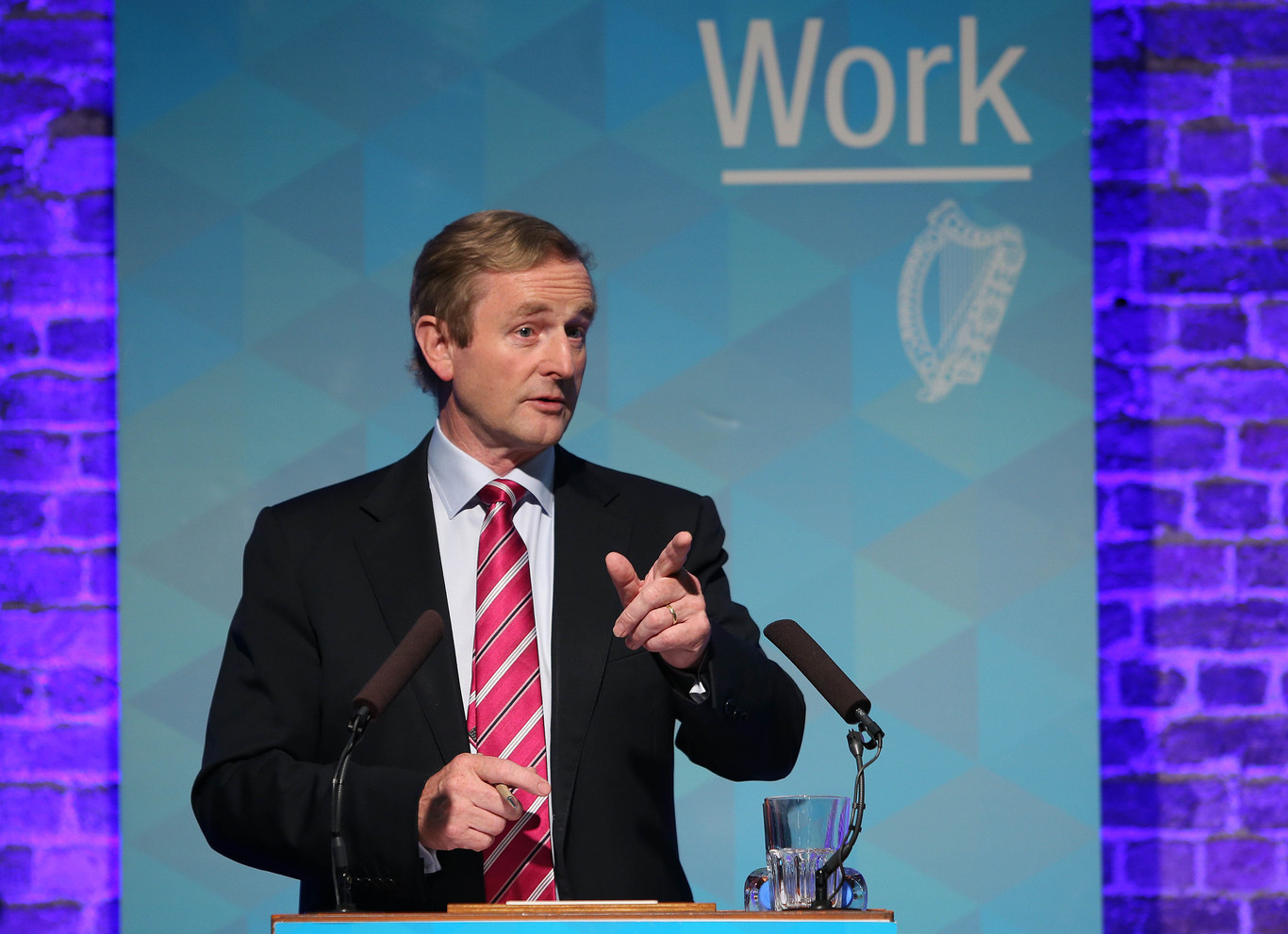

IN CASE YOU missed the news late last week and over the weekend, Ireland finally has a government after 10 weeks of political wrangling.

A widely circulated draft programme for the new administration, a document that was key to luring independents to support Fine Gael in power, set out the government’s proposed agenda on tax and other key issues.

Among the points likely to be of interest to those in the business community, if the document becomes official policy, is a pledge to cut the capital gains tax rate for new startups to 10% on amounts up to €10 million. That would bring Ireland’s much-criticised tax system for entrepreneurs closer into line with that of the UK.

The document also flagged unspecified reductions to personal tax rates based on, among other measures, a tax on sugar-sweetened drinks, higher tobacco excise and the removal of the PAYE tax credit for high-earners.

The discount VAT rate on tourism-related services would be maintained, it said, “providing that prices remain competitive”.

The phase-out of the USC would be continued, although the document also said indexation of personal tax credits and bands would be dropped – a move that would potentially eat up the net benefits of tax cuts once inflation kicked in.

The document set out a target of 200,000 extra jobs by 2020 and an unemployment rate of 6%. That included a pledge to “protect national competitiveness from unsustainable cost growth”, while it also promised to lift the minimum wage to €10.50 per hour over the next five years.

The self-employed will also progressively get their tax credit raised to €1,650 by 2018 to match that available to PAYE workers, while the government will “seek to introduce” a PRSI scheme for the sector.

Meanwhile, Enterprise Ireland and Údarás na Gaeltachta have been promised another €300 million in capital funding over five years, while the IDA will get an extra €200 million.

However there was little in the proposals to indicate the government’s long-awaited, and recently further delayed, National Broadband Plan would get a further kickstart. Nor is there any sign of the small business minister that lobby groups have been calling for.

The pledges in the yet-to-be-published document also come with the very large caveats that they need to be both budgeted for and officially approved before they ever see the light of day.

So with that information at hand, we want to know: Do you think the new government will make Ireland better for business?

Have more to say? Tell us in the comments below