The taxman is coming after building companies as the property sector recovers

Revenue says the potential for tax evasion in the sector is a concern.

REVENUE HAS BEEN targeting the construction sector as one of the primary sources of tax evasion as the industry rides the wave of recovery back into profitability.

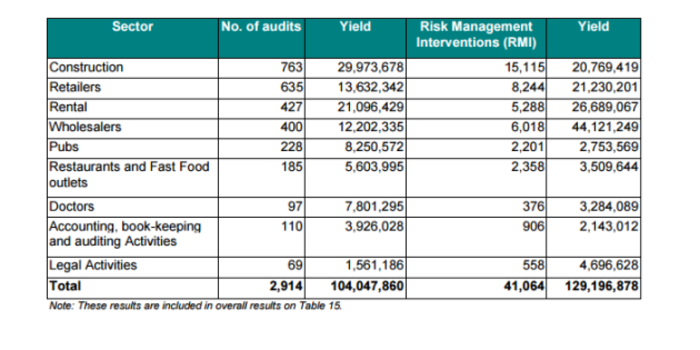

As part of its enforcement actions, tax collectors carried out 763 audits into construction companies last year, the highest level recorded in any sector.

The investigations yielded just under €30 million, almost one-third of the total funds recovered through audits, although the number of cases and amount handed over was slightly down on the 2014 tallies.

Last year, the retail and rental industries were respectively the second- and third-biggest targets for audits, based on the total volume of tax probes.

Click here for a larger version

Trends

Speaking to Fora, Revenue commissioner Liam Irwin said the construction sector needs to be properly regulated as it begins to recover from the economic crash and he expects to see a similar trend of audits in 2016.

“It will be the same again this year, construction is beginning to re-emerge with the growing economy,” he said.

Irwin said the industry needs higher levels of oversight due to the nature of the business, such as the high prevalence of contract workers, which can lend itself to instances of both tax avoidance and evasion.

Revenue commissioner Liam Irwin

Revenue commissioner Liam Irwin

“It’s probably more evasion than avoidance in the construction industry,” he said. “It (construction) accounted for a huge amount of our tax revenues before the bust, almost one-fifth of all revenues.

“Then after the downturn that went and took maybe €10 billion out of the tax take almost overnight, so you really want to make sure that the industry is legitimate.

“We would be generally concerned. What we’re seeing is probably that things are better than they were before, apparently because the regulatory regime is better, but we feel we need to be on top of it all the time.”

Building sector

Construction consultancy firm Bruce Shaw predicted earlier this month that Ireland’s construction output could grow by 20% this year to about €15 billion.

However, this is still less than half the level seen at the peak of the boom in 2007, when output peaked at €38 billion, representing one-fifth of Ireland’s total economic output.

The industry’s performance is also still well below general European standards, which would normally see it responsible for between 10% and 12% of GDP. To achieve this, the output of the Irish construction industry would be worth up to €24 billion.

In total, Revenue carried out 6,612 audits across all industries in 2015, yielding €327.9 million, while the organisation collected an additional €314.6 million through “non-compliance interventions”.