Hungary is bringing in the EU's lowest corporate tax rate

The competition to attract multinationals’ investment keeps heating up.

THE HUNGARIAN GOVERNMENT will undercut Ireland’s much-publicised corporate tax rate, introducing the lowest levies on profits for businesses anywhere in the EU.

A statement on the Hungarian government’s website today, from prime minister Viktor Orbán, said the country’s tax rate would move to the “single digits” next year with a charge of 9% for companies of all sizes.

The eastern European nation, which has a population of around 10 million, previously charged a 10% rate on the first 500 million forints (€1.6 million) of profits, with the rate reverting to 19% for all larger amounts.

The new company tax rate will offer firms a discount on Ireland’s flagship 12.5% corporate tax rate, currently one of the lowest in the European bloc.

Only Bulgaria, with a corporate tax rate of 10%, has a lower rate, while Cyprus also charges 12.5%.

Hungary has traditionally had one of the highest per-capita rates of foreign investment in central and eastern Europe, pitching itself as a bridge between east and west within the EU.

However the investment inflows plunged with the financial crisis and foreign investment stocks have been slow to rebound since.

Nevertheless, the country has secured significant investments in recent years from major firms such as Audi, Bosch and Xerox.

Like Ireland, the country highlights its highly educated workforce as a major plus to multinational firms, but it also has the fifth-lowest average labour costs in the EU.

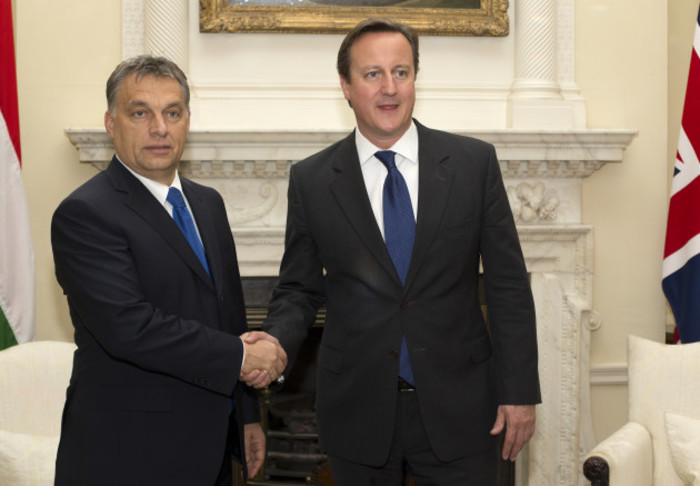

Hungarian prime minister Viktor Orbán, left, with David Cameron

Hungarian prime minister Viktor Orbán, left, with David Cameron

Tax competition

The changes come as other governments increasingly follow Ireland’s tactic of using low corporate taxes to lure multinationals to create jobs in their countries.

The UK has also signalled plans to lower its corporate tax rate to 15%, while US president-elect Donald Trump also wants to move to a 15% rate.

Research from think-tank the ESRI, released earlier this year, found that Ireland was more dependent on low taxes to attract firms from outside the EU than any other country in the region.

The Republic was particularly sensitive to shifts in the UK’s company tax rate, with a 1% cut making Ireland 4% less attractive for extra-EU investment.

Meanwhile, around four-fifths of Ireland’s corporate tax take last year came from multinationals, with government officials warning that the volatility of the income stream was one of the key risks facing the country’s economy.