Irish middle income earners pay more tax than the Swedish

High income earners also pay far more tax than those on the bottom rung.

MIDDLE-INCOME EARNERS in Ireland pay some of the highest tax rates in the OECD and more than their equivalents in Sweden, a new report has found.

In a pre-budget report, the Irish Tax Institute compared Ireland’s personal tax system to 10 other peer countries.

It found that those earning less than €18,000 a year in Ireland paid less tax than in any of the other nine countries.

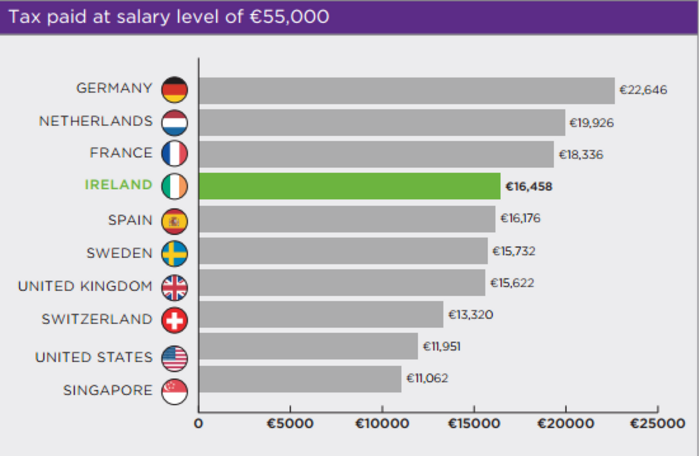

In contrast those who took home €55,000 annually paid the fourth highest rate of tax, more than their equivalents in Sweden.

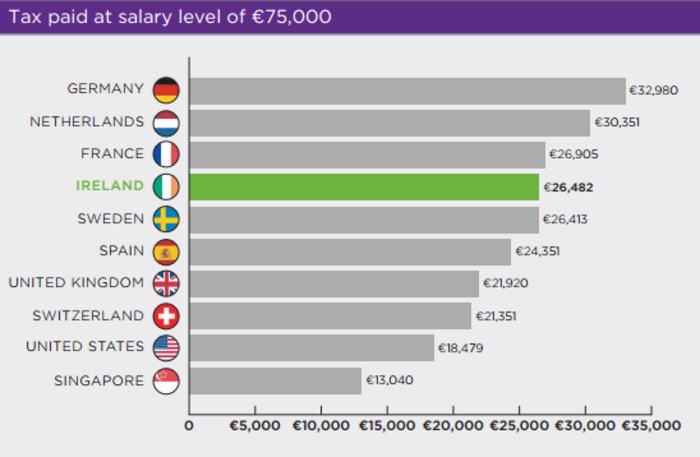

The analysis by the Institute also illustrated how quickly taxes rise as you go up the income scale in Ireland. The tax paid rises very progressively as workers progress through the salary levels with the progressivity accelerating from €75,000 onwards.

- A worker on €25,000 earns almost 1.4 times the salary of a person on €18,000 but pays 5.6 times the tax.

- A worker on €35,000 earns 1.9 times – but pays 10.9 times the tax.

- A worker on €75,000 earns 4.2 times but pays 44.1 times the tax.

- A worker on €100,000 earns 5.6 times but pays 65.8 times the tax

- A worker on €120,000 earns 6.7 times pays 83.1 times the tax

The report compared Ireland to France, Germany, the Netherlands, Spain, Sweden, Singapore, Switzerland, the UK and the US.

Taxes, taxes, taxes

It showed that Irish workers who earned a salary of €18,000 paid €600 tax in a year, a fraction of that paid by employees on the same wage in Germany.

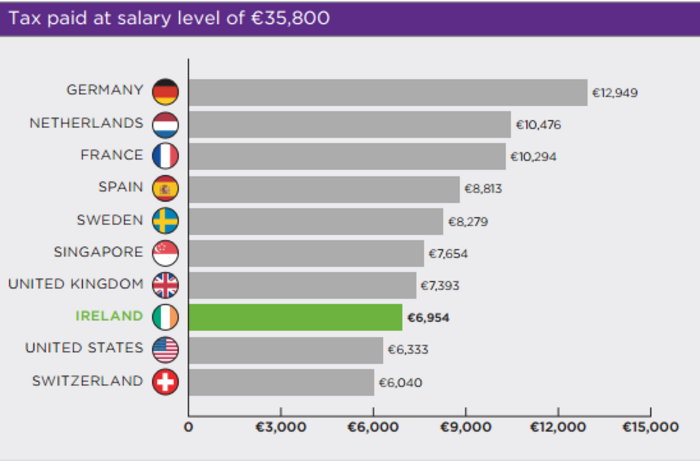

Ireland also ranked near the bottom for the tax paid by lower-to-middle income earners. Those with a salary of €35,800 paid tax of just under €7,000 in Ireland, but this was well below the level paid in countries such as the Netherlands and France.

However, this position starts to change as Irish workers earn more. Those on a salary of €55,000 in Ireland paid about €16,500 in tax a year, more than workers on the same wage in Sweden.

This remained the same for higher income earners on salaries of €75,000, who saw more than a third of their pay go towards tax. This was again ahead of Sweden, although only marginally.

High earners

The report highlighted the share of Ireland’s tax that is being paid by high earners, and said it has become “notable” in recent years.

“For example, in 2015, the top 1% of income earners paid 19% of all personal taxes while just twelve months later this is estimated to be 22% (and) the top 50% of income earners, those earning above €30,000, pay over 96% of the personal tax take,” it said.

“By the time you get to €75,000 we are a high tax country by international comparison and that remains the case as salaries increase.”

The report also highlighted how complicated Ireland’s tax system is, and noted “over 50 different tax changes have impacted Ireland’s personal tax system in the past seven years and had led to 53 moving parts in personal taxes”.

Irish Tax Institute President Mark Barrett said that it is important to recognise “that Ireland’s progressivity is second only to Israel in the OECD”.

“There was a universal appreciation that ‘needs must’ and that in the early years of the crash a blunt approach to increasing tax yields was essential,” he said.

“However, the combined impact of those changes and the way they have been ‘to some extent’ unwound has left some interesting traits on the Irish personal tax system.”