Irish employers 'should get money back' when their staff are made redundant

Businesses used to be able to claim a rebate to help cover the costs.

THE GOVERNMENT SHOULD reintroduce a rebate to help employers cover the cost of redundancy payments, according to a prominent business group.

The proposal was contained in ISME’s pre-budget submission, which was formally launched today.

Up until 2012, an employer making statutory redundancy payments to former staff was able to claim back a 60% rebate from the state to help cover the cost. This rate was reduced to 15% in 2013, and the rebate was abolished altogether afterwards.

When an employer cannot make redundancy payments, staff are paid by the social insurance fund. In this case, the business must then repay the state 85% of the amount spent.

ISME, which represents small and medium businesses across Ireland, has called for the rebate to be reintroduced.

The group said that employers’ contributions to the social insurance fund were set at 0.5%, collected through PRSI, which would help businesses pay the cost of redundancies.

Wrong

ISME added that the PRSI charge was maintained even after the rebate was abolished, a situation that the lobby group said was unfair to employers.

“While stating that removal of a rebate was wrong, we acknowledge it was done in straitened times,” its submission said.

“This justification no longer exists; yet the continued refusal to rebate redundancy payments discourages employers from taking on employees in potentially marginal cases.

“One of the unintended effects of making redundancy more expensive or difficult for employers is that they are less likely to hire employees, and more likely to use agency or contracted labour.”

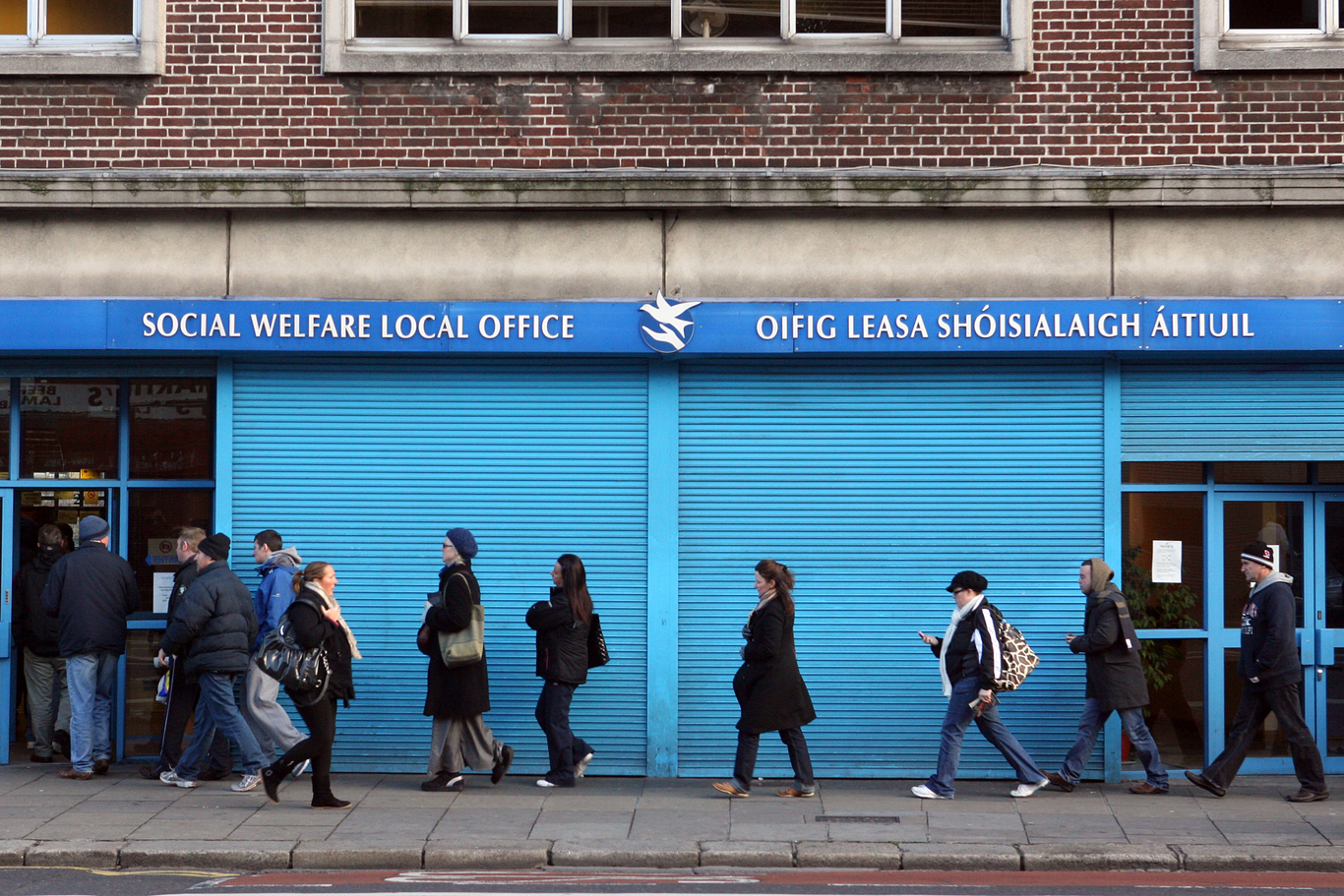

People queue at a social welfare office

People queue at a social welfare office

The group added: “The statutory redundancy rebate should be reinstated at its 2012 level (of) 60%. Failing this, the requirement to pay statutory redundancy should be eliminated, or, employers’ PRSI should be reduced by 0.5% in lieu.”

Expense

ISME said that employers’ payments to the redundancy fund generated a “substantial surplus over the liabilities from the fund”.

It said that the fund was able to transfer a lump sum of over €600 million to the Exchequer in 2002.

However, the rebate proved to be a significant expense to the state with the onset of the recession.

More than €1.3 billion in rebates were paid out by the state between 2007 and the start of 2014 as struggling firms laid off staff.

ISME’s submission also made several other recommendations. These include:

- Reducing the marginal rate of income tax from 52% to 38%;

- Raising the point at which workers must start paying the marginal rate of tax to €40,000 for single people. At the moment the rate is paid on all earnings after €33,800;

- Abolishing all perks and reverting to a basic salary for all public-sector employees.