'The UK has stolen a march on Irish business'

The Dublin Chamber of Commerce says that Ireland lags behind the UK in almost all of the main tax rates.

IRELAND IS FALLING behind the UK and must bring more of its tax rates into line if it is to catch up.

That is according to the Dublin Chamber of Commerce which says that the Irish government must show a commitment to entrepreneurs and businesses in the same way that the UK has done over the past five years.

Dublin Chamber’s director of public affairs Aebhric McGibney said that the UK “has stolen a march on Ireland in recent years by following through on David Cameron’s 2011 promise of rolling out the red carpet for entrepreneurs.”

The group also said that the Irish government needs to act in the wake of the news that the UK is planning to cut its corporate tax rate.

UK Chancellor George Osborne revealed that he will cut the rate, which currently stands at 20%, down to 15% in a move that will bring it into direct competition with Ireland for foreign investment.

Wake-up call

McGibney said that the action “should serve as a wake-up call to the Irish Government”.

“We must now concentrate on rolling out the green carpet for business, which will allow us to maximise the opportunities thrown up by a British exit from the EU,” he said.

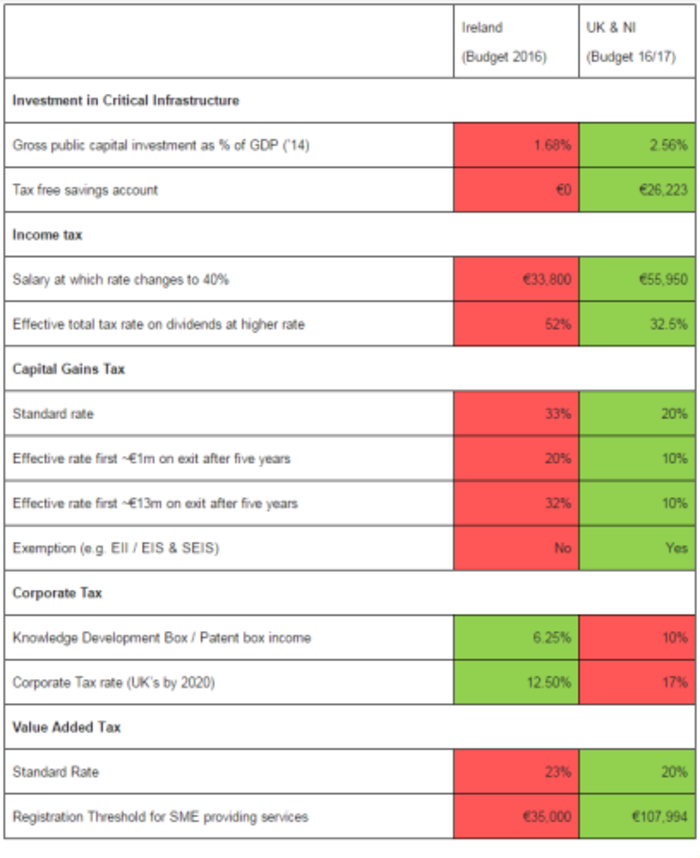

In its pre budget submission the group compared 12 of the main tax rates available in the UK and Ireland and found that what is available in Ireland comes up short in 10 of the 12 categories examined.

The different tax rates compared by the Dublin Chamber of Commerce

The different tax rates compared by the Dublin Chamber of Commerce

Not all of the rates compared by the chamber are tax rates. For example, the organisation compared how much each nation invests in infrastructure as a percentage of its GDP, which found that the UK spent 2.7% compared to 1.7% in Ireland.

Four of the comparisons also related exclusively to capital gains tax, which is the rate that charges are levied on the profit from the sale of an asset.

Tax changes

Dublin Chamber is calling for a number of changes to tax rates, including a reduction in the rate of capital gains tax to 10% for entrepreneurs up to a lifetime limit of €10 million and an employer’s PRSI tax credit which it said will help micro-businesses hire more staff.

McGibney said that there needs to be a strong focus on “ensuring that Ireland has a pro-business tax regime which is competitive with what is on offer in the UK”.

He added: “The government must act decisively and boldly to attract new business to Ireland to help firms already present here to grow and create jobs.”