Bank of Ireland almost always sticks to its guns after knocking back business loans

The bank was nearly twice as likely to reject appeals from borrowers than its main rival.

BANK OF IRELAND refused more than four-fifths of internal credit appeals from companies that believed they were unfairly denied loans, new figures have revealed.

The statistics are contained in a report by the Credit Review Office (CRO), a state-backed appeals body for businesses refused bank loans or that have existing credit lines cut.

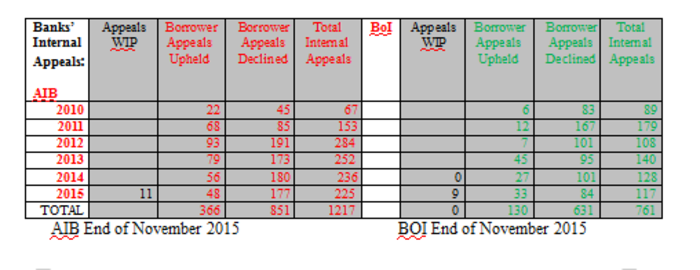

Statistics recently published by the CRO show that Bank of Ireland upheld only 130 internal appeals out of 761 applications between 2010 and 2015.

In comparison, AIB handled just over 1,200 internal appeals during the same period and upheld 366 claims from customers that felt they shouldn’t have been denied funding.

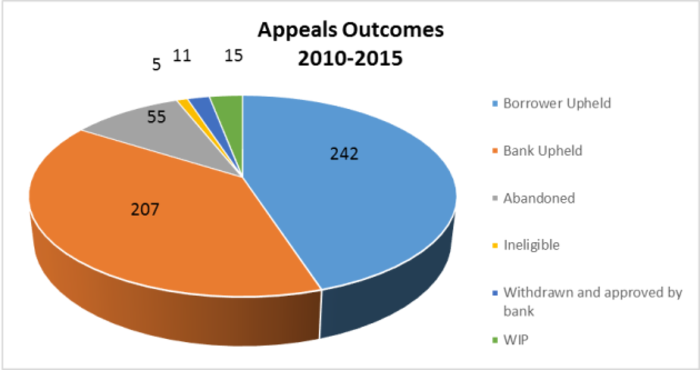

Of the nearly 1,500 customers who had their appeals knocked back by the two banks, more than one-third pursued cases with the CRO. The largest share of those appeals were upheld in the borrower’s favour, while a slightly smaller proportion went the banks’ way.

The CRO said that successful appeals resulted in almost €34 million more funding being made available to SMEs and farms and the protection or creation of over 2,300 jobs.

The office has the power to force banks to overturn their decisions on amounts worth up to €3 million.

Credit Review Office head John Trethowan

Credit Review Office head John Trethowan

SME lending

However the appeals represent only a fraction of the total business lending carried out each year by the two banks, which both lend billions of euro to thousands of companies.

A Bank of Ireland spokeswoman did not respond directly to questions about the bank’s high refusal rate for appeals. She did, however, say the bank accounted for more than 50% of new lending to SMEs and agribusinesses in 2015.

Meanwhile, a spokeswoman for AIB said the bank approved 95% of formal credit applications from SMEs and that providing credit “to help businesses prosper and grow is core to AIB’s strategy”.

Bank internal appeal outcomes

Bank internal appeal outcomes

Lack of awareness

A CRO spokeswoman said the organisation is receiving about 100 applications per year and that number is expected to remain steady in the near future.

For around a year, both pillar banks have started mentioning the option of appealing to the office in their rejection letters. However, the spokeswoman said that the number of cases that the organisation has dealt with has remained “surprisingly consistent”.

“For the companies who are rejected, only about one in three comes to us,” she said.

“We thought when the banks started sending out the letters we would be inundated, but it hasn’t worked out like that. A lot of SMEs read the first line of the rejection letter and don’t read anymore.”

The CRO was previously open only to customers of the two main banks, however Ulster Bank recently joined the scheme voluntarily. Permanent TSB, which announced a new bank offering for SMEs at the end of 2015, is also set to make the scheme available to its customers.

Meanwhile, a survey of 1,500 SMEs published by the Department of Finance last September showed just over half the companies that were refused credit said they were unaware of the CRO. The figure was down from 60% in September 2014.

The study also found that, overall, banks either fully or partially approved 74% of applications from SMEs.