Companies are moving their intellectual properties to Ireland - and the government is cashing in

The country has taken in more than €3 billion in corporate tax so far this year.

COMPANIES MOVING THEIR intellectual properties to Ireland is the likely cause behind a surge in corporate tax receipts here, it has been claimed.

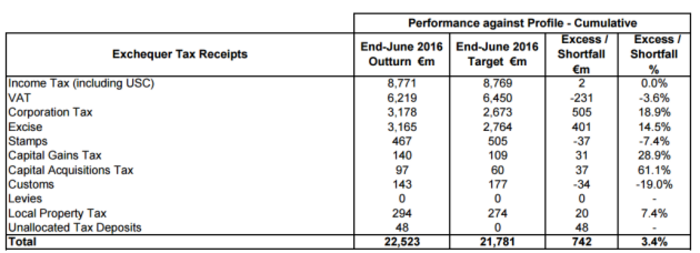

Tax receipts for the six month period to the end of June were €742 million ahead of target, according to the latest Exchequer returns.

The government collected €22.5 billion in tax revenue during the first half of the year, up by almost €2 billion compared to 2015.

While there were increased receipts for several types of taxes, corporation tax recorded one of the most significant jumps.

The Department of Finance said that corporation tax receipts during June were “strong”, up by €21 million more than was expected. For the six month period, the tax took in almost €3.2 billion, 19%, or €505 million more than the state had anticipated.

Grant Thornton tax partner Peter Vale said that the surge is likely due to companies moving their intellectual properties here.

“A possible explanation for the strong corporation tax receipts is companies moving their valuable intellectual property (IP) and related profits away from tax havens to Ireland,” he said.

Profit shifting

Companies get IP protection for products that they develop. Some companies have transferred these rights to a subsidiary in low tax countries, and then charge other group subsidiaries to use the IP.

For example, if company A holds the IP for a piece of software and company B uses the software, A can charge B to use the software even when they are both subsidiaries owned by the same firm. If A is located in a low tax country, it reduces the overall tax paid by the ultimate parent company.

If companies are moving their IPs to Ireland it means that the state is likely receiving more revenue from these IP sales. As more countries are trying to crack down on tax avoidance, many companies are looking to move their IPs out of so-called tax havens.

Vale said that he expected this trend to continue in light of the international community’s attempts to crack down on profit shifting by big companies.

He referenced the OECD’s Base Erosion and Profit Shifting project, which is a series of measures recommended by the OECD aimed at closing legal loopholes that allow multinational companies to shift their profits through low-tax countries.

“This is a trend we expect to see continue as groups reorganise in light of the OECD’s BEPS anti-tax avoidance drive, with a greater alignment of taxable profits and real substance. This is a significant opportunity for Ireland,” Vale said.

Ever improving

Excise duties also performed strongly. Receipts during the month of June were €63 million, or 13.8%, above target. Altogether, by the end of June excise duties took in of €3.2 billion up €401 million, or 14.5%, against expectations and up €716 million year-on-year terms.

Contributing to this was a rise in car sales and increased imports ahead of the introduction of plain packaging laws which is expected to unwind in the second half of the year.

Overall the Exchequer recorded a deficit of €1.1 billion compared to a deficit of €292 million in the same period last year.

The Department of Finance said that the difference was due to the €2.1 billion windfall that the state received in 2015 when it sold part of Permanent TSB.

Stripping this out the Exchequer shows an underlying year-on-year improvement of €1.3 billion.

Finance Minister Michael Noonan said that the receipts “show our plans to fund vital public services are on track and that collecting revenues from a broad base continues to pay dividends for Irish taxpayers”.