The Dublin commuter counties have the highest bankruptcy rates in Ireland

Kildare had the largest share, per person, in the country.

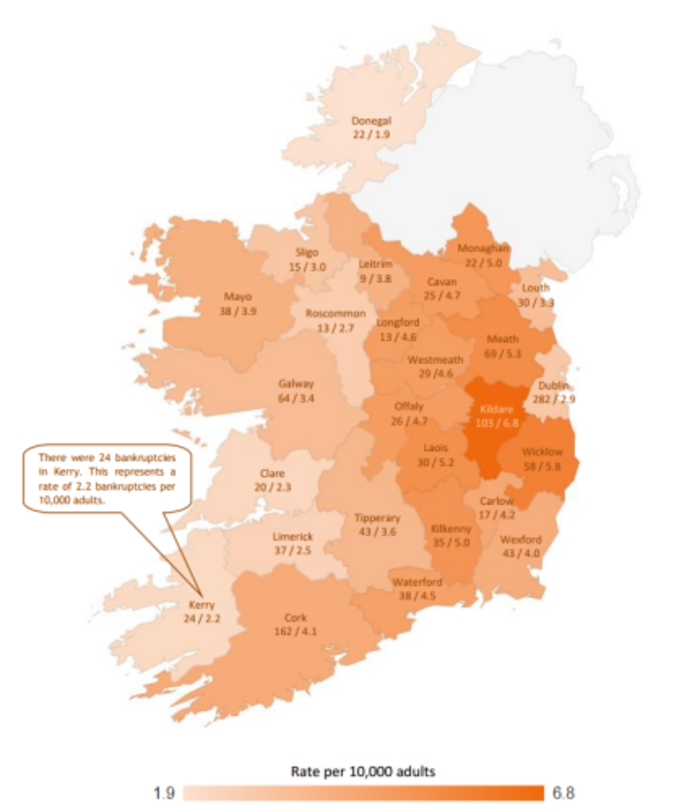

KILDARE IS THE Irish county with the highest number of bankruptcies per head in the country, but rates are also high in other counties in the Dublin commuter belt.

New statistics from the Insolvency Service of Ireland (ISI) show that, in the period from the start of 2014 to the end of the third quarter of 2016, there were 103 bankruptcies in Kildare.

This represented a rate of 6.8 bankruptcies per 10,000 adults, the highest share of any county in the country.

Bankruptcy is a process through people who can’t pay their debts have their assets distributed among their creditors – while offering individuals protection from the same creditors.

Overall, the bankruptcy rates were high across a range of Dublin commuter counties. There were 58 cases in Wicklow during the period, a rate of 5.8 per 10,000 adults, and 69 in Meath, 5.3.

Unsurprisingly, Dublin reported the highest overall number of bankruptcies – 282 as of the end of the third quarter of the year.

Bankruptcy rates were lowest in western counties such as Clare and Limerick, which had rates of 2.3 and 2.5 per 10,000 people respectively.

Property

When asked why the Dublin commuter counties tended to have higher than average bankruptcy rates, an ISI spokesman said: “It is not possible to be specific. However (unsustainable) property investments is one of the main ‘drivers’ leading to bankruptcy.”

After the crash, property prices dived in commuter counties such as Kildare and Meath, which were inflated by the housing bubble, dropped sharply, likely leaving many people in negative equity.

However, house prices have begun to recover in these counties as in the last year or so as the economy improves and a lack of affordable properties drives many would-be house buyers further outside Dublin.

House prices dropped in Dublin commuter counties after the crash

House prices dropped in Dublin commuter counties after the crash

Up and down

Overall, bankruptcy adjudications fell slightly across the country in the third quarter of the year compared to the same period in 2015, dropping from 83 to 61.

This was also a significant decrease compared to the second quarter of 2016, when there were 173 bankruptcy adjudications.

However, the ISI noted: “While bankruptcy numbers are down this quarter, this is partially reflective of the Bankruptcy Court’s summer recess.”

The total debt involved in bankruptcy adjudications for the quarter was about €104 million.

At the start of this year, the bankruptcy term was reduced from three years to one year, a move that was welcomed by debt campaigners at the time.

More broadly the ISI said that there were 899 new applications to use its services this quarter, more than double the rate that was witnessed during the same quarter of 2015.

The ISI said that it has assisted “over 4,000 people to return to solvency to date”.