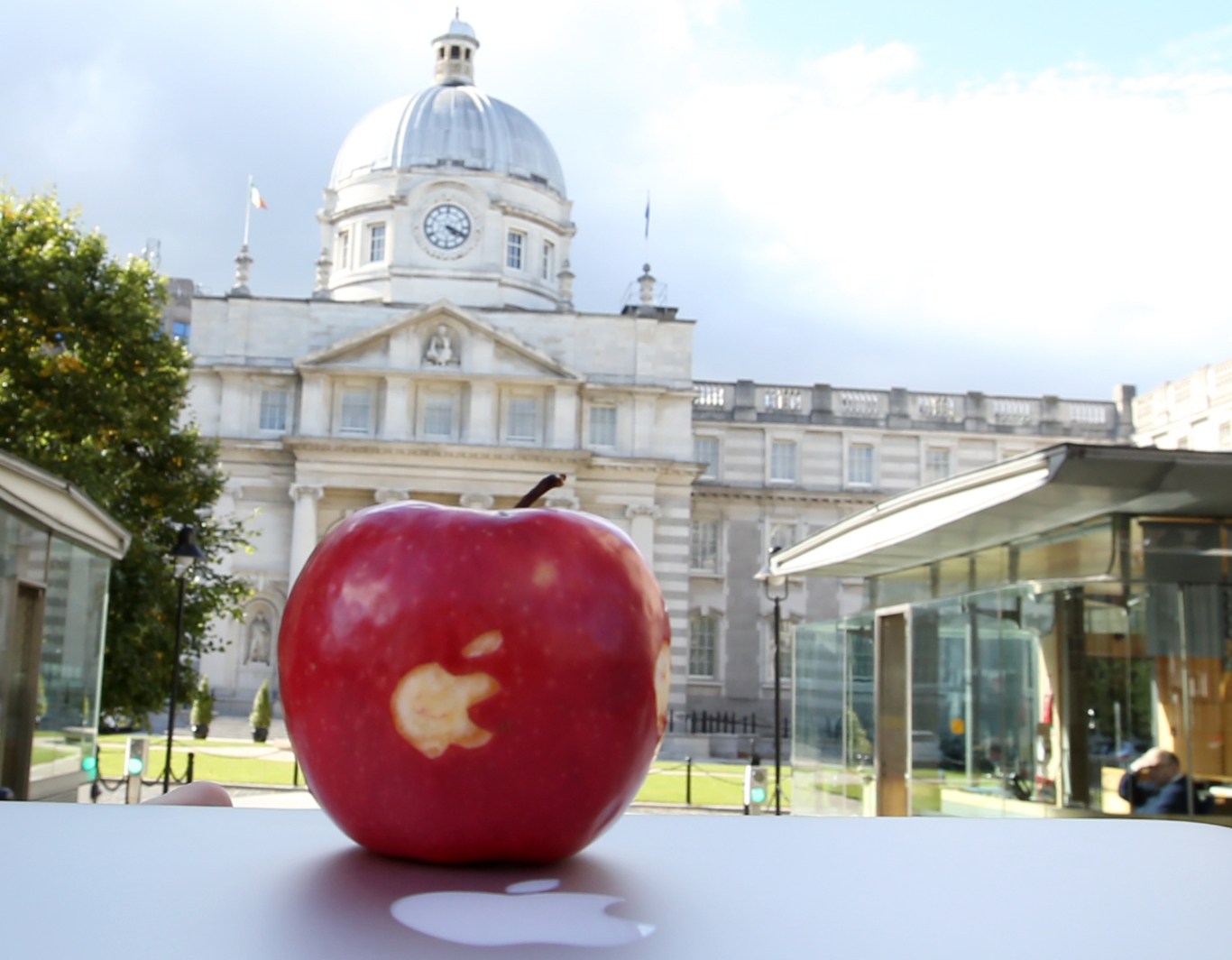

Apple claims it is a 'convenient target' as EU to publish full ruling on Irish taxes

The EU ruled that Ireland struck a tax deal with the tech giant worth up to €13 billion over a decade.

APPLE HAS CLAIMED that it is a “convenient target” in an EU crackdown on tax avoidance, claiming that it was targeted because of its success.

The claim comes as the EU Commission is set to publish its full decision on its controversial finding, first announced in August, that Ireland gave the tech giant illegal state aid worth up to €13 billion over a period of more than a decade.

Apple’s general counsel Bruce Sewell told news agency Reuters that the company intends to lodge an appeal against the Commission’s ruling at Europe’s second highest court this week.

“Apple is not an outlier in any sense that matters to the law. Apple is a convenient target because it generates lots of headlines,” Sewell said.

He told Reuters that Apple will tell judges the Commission was not diligent in its investigation because it disregarded tax experts brought in by Irish authorities.

“Now the Irish have put in an expert opinion from an incredibly well-respected Irish tax lawyer. The Commission not only didn’t attack that, they probably didn’t even read it. Because there is no reference (in the EU decision) whatsoever,” Sewell said.

Appeal

The move comes as Irish officials set out how they will take on the European Commission over the controversial ruling.

A statement from the Department of Finance asserts that the Commission “never clearly explained its state aid theory during the investigation, and the decision contains factual findings on which Ireland never had the chance to comment.

“The Commission breached the duty of good administration by failing to act impartially and in accordance with its duty of care.”

The EU’s competition commissioner, Margrethe Vestager, has argued that the deal Ireland offered Apple allowed the tech firm to pay a corporate tax rate of 1% on its European profits in 2003 – down to 0.005% in 2014.