Ireland's sweetheart tax deal for Apple was worth up to €13 billion over a decade

The European Commission has ordered the government to recover the illegal state aid.

IRELAND GAVE APPLE illegal state aid worth up to €13 billion over a period of more than a decade, the European Commission has said.

The government has been ordered to recover the funds – plus interest – from the Californian firm.

However it could be years before the money is made available with appeals against the ruling from both Ireland and Apple expected to drag on in the courts.

The final decision on how much is owed will also be left up to Irish authorities, which the commission has directed to work out Apple’s unpaid tax bill.

Other countries can also seize on the commission’s investigation to claim they are due a slice of the profits on billions in untaxed sales the company routed through Ireland.

Near-zero tax

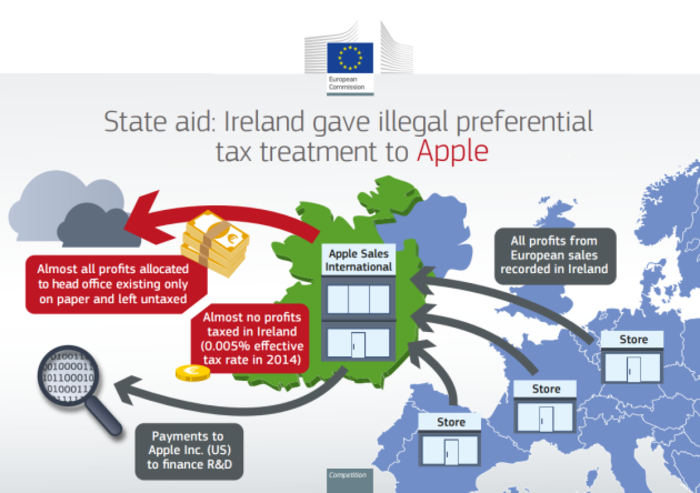

In a statement this morning, the commission said the deal between Apple and Ireland allowed the company to pay a tax rate of only 1% on its European profits in 2003, with that figure sliding to as little as 0.005% by 2014.

The case centres on two tax rulings the Irish government agreed with Apple in 1991 and 2007, which the commission said provided the multinational company with a selective advantage over other companies.

The agreements involved two companies, Apple Sales International and Apple Operations Europe, both incorporated in Ireland.

However only the first firm paid taxes in the Republic, with the second effectively “stateless” despite being the company’s head office for Europe and several other territories.

The commission said this profit-allocation setup, endorsed by Ireland, had “no factual or economic justification”.

Competition commissioner Margrethe Vestager today said the “so-called head office only existed on paper – it has no employees, no premises and no real activities”.

In 2011, Apple Sales International recorded a profit of €16 billion – however less than €50 million from this was allocated to the Irish branch. The remainder was assigned to the head office, which paid zero taxes.

EU commissioner Margrethe Vestager

EU commissioner Margrethe Vestager

Vestager said other EU countries will now have the option to try and take a piece of the tax pie if they can prove some of Apple’s profits that went tax-free in Ireland were really based on sales that should have been recorded in their territories.

US authorities could further claim part of the profits if they decided more was due in Apple’s home country for intellectual property or other intra-company dealings.

Any significant windfall that eventually makes its way to the Irish state will be required to go towards the Republic’s debt bill, rather than to be used on fresh spending.

‘Profound’ disagreement

Responding to the decision, Finance Minister Michael Noonan said he disagreed “profoundly” with the decision.

“Our tax system is founded on the strict application of the law, as enacted by the Oireachtas, without exception,” he said.

“The decision leaves me with no choice but to seek Cabinet approval to appeal the decision before the European courts.

“This is necessary to defend the integrity of our tax system, to provide tax certainty to business and to challenge the encroachment of EU state aid rules into the sovereign member state competence of taxation.”

Finance Minister Michael Noonan

Finance Minister Michael Noonan

The commission insisted the decision didn’t “call into question Ireland’s general tax system or its corporate tax rate”.

The Republic has been considered a tax pariah in certain European circles for its 12.5% headline rate, which is close to one-third the corporate tax rate in some member states.

The chairman of the Revenue Commissioners, Niall Cody, denied there had been any sweetheart deal for Apple – insisting that the full tax the company owed under Irish laws had been paid.

‘Harmful for job creation’

Apple also issued a strongly worded statement after the ruling, claiming the decision would have a “profound and harmful effect on investment and job creation in Europe”.

“The European Commission has launched an effort to rewrite Apple’s history in Europe, ignore Ireland’s tax laws and upend the international tax system in the process,” it said.

While the company said it obeyed all tax laws wherever it operated, it said the EU investigation wasn’t about how much it paid in taxes – but which government got to claim that money.

The commission first accused Ireland in 2014 of breaking tax rules by offering a sweetheart deal to Apple, allowing the tech giant to route billions in profits through the country virtually tax-free in return for jobs.

Apple now employs around 5,000 people in Cork, making the firm the largest private-sector employer in the region. The company opened its first manufacturing plant at Hollyhill in 1980.

The penalty is by far the largest-ever for a case before the European Commission, dwarfing the €300 million engineering firm Atlas Copco was ordered to pay Belgium earlier this year.

Apple CEO Tim Cook

Apple CEO Tim Cook

Transatlantic tax fight

The decision follows the publication of a white paper from the US Treasury last week which accused the commission of taking an approach that “undermines the international tax system” and acting as a “supra-national tax authority”.

The US and EU have been engaging in an escalating transatlantic tug-of-war over multinationals’ profits in recent years. Washington argues US companies’ global profits should be taxed in their home country, while Brussels wants its slice for member states based on where the income is actually earned.

The Department of Finance took a strong swipe at the commission in a statement after the ruling, claiming state-aid rules were being used in a “new and unprecedented way in the area of taxation, which is a member state competence and a fundamental matter of sovereignty”.

“Ireland has very real concerns about the way in which the European Commission is undermining the international consensus, impeding reform and creating uncertainty for business and investment in Europe,” it said.