One tax that took a huge dive in the crash may not bounce back for years

Capital gains tax plunged when the property bubble burst.

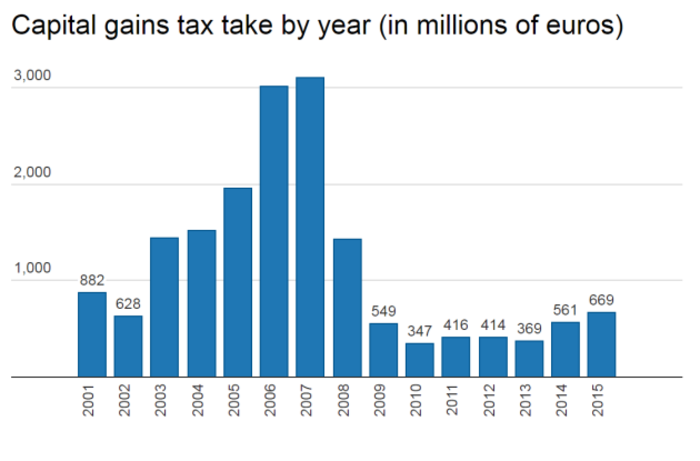

IRELAND’S TAKE FROM capital gains tax is still a fraction of what it was during the boom, despite the economic recovery.

According to figures compiled by Fora, the Exchequer took in €669 million in capital gains tax (CGT) in 2015, up from €561 million the year before.

However, this was a fraction of the take before the economic downturn. CGT, the charge applied to the profit made from the disposal of any asset, accounted for just under €2 billion in income for the Exchequer in 2005 and slightly over €3 billion each of the two following years.

When the crash hit, however, the tax nosedived, bottoming out at just €347 million in 2010. The CGT take so far this year stands at €113 million, according to official figures released on Monday.

The bubble effect

Investec chief economist Philip O’Sullivan said that the drop was likely due to several factors, the most obvious being the collapse in the property sector.

“Property prices are still significantly below peak levels, so disposals of investment property and land acquired before the bubble will yield a lower CGT take than they would have had they been sold in the mid noughties.”

He added that the CGT take may be depressed because investors are utilising losses from the crash.

“For example, those who lost money on Irish bank shares can use those losses to offset gains on other assets,” he said.

Two other factors he cited were a general reduction in disposable income during the recession and the increase of the CGT rate, which rose from 20% in 2008 to its current rate of 33%.

“As this reduces the gains on disposal, all else being equal it is a disincentive for people to transact. Fewer transactions means less scope for a CGT event,” he said.

Investec chief economist Philip O'Sullivan

Investec chief economist Philip O'Sullivan

Special rate for entrepreneurs

Entrepreneurs and business groups have long argued for a reduction in the CGT rate. Although the government introduced a lower rate of 20% on certain sales, it only applies to the first €1 million in profits.

Irish Venture Capital Chairman Brian Caulfield recently told Fora that the CGT rate should be divided in two, as it is in the UK, with a lower rate for entrepreneurs who sell their businesses.

Mr O’Sullivan said he expects CGT receipts to increase in the coming years as asset values recover and losses suffered on investments during the crash are used up.

He added that he does not expect a return in the near future to pre-crash levels: “It was inflated at its peak because of frantic transaction activity and a credit-fueled asset bubble.”

Several other Exchequer receipts have made up the shortfall from CGT, most notably corporation tax, which took in €6.9 billion in 2015 compared to €4.6 billion the year before.